Receive the DailyFX US AM Digest in your inbox every day before US equity markets open – signup here

US Equities set to open on the front foot with equity futures showing gains of around 0.5%. Slight reprieve in equities with geopolitical headlines on the lighter side this morning, also some slide backtracking from President Trump who tweeted an attack may not happen, which is in stark contrast to yesterday’s (missiles are coming) rhetoric.

EUR: The Euro is notably weaker this morning following relatively dovish ECB minutes. The release highlighted trade wars risks, as well as the appreciating Euro as a cause of concern for economic outlook. The minutes also seemingly at odds with recent comments from Nowotny who stated that a 20bps deposit rate hike in 2019 could be appropriate. Additionally, soft Eurozone production data, adds to the recent subdued economic data points, maintaining the narrative that Euro-Area growth is cooling. EUR/GBP dipping below 0.8700 with the 2018 low residing at 0.8667 back in sight.

USD: Underlying support derived from yesterday’s hawkish FOMC minutes release is keeping the USD firm today. The minutes stated that several policy makers arguedfurther gradual rate hikes may be appropriate, implying a steeper rise in the Federal Funds Rate than previously expected, odds of 4 rates hikes have now notched up again. However, the USD remains sensitive to geopolitical headlines, which have been on the lighter side today.

CHF: The weakening trend continues for the Swissie with the usual culprit seen to be SNB intervention. EUR/CHF moving to just shy of the 1.19 level (highest since drop of EUR/CHF floor), the pair continuing to eye a move towards 1.20.

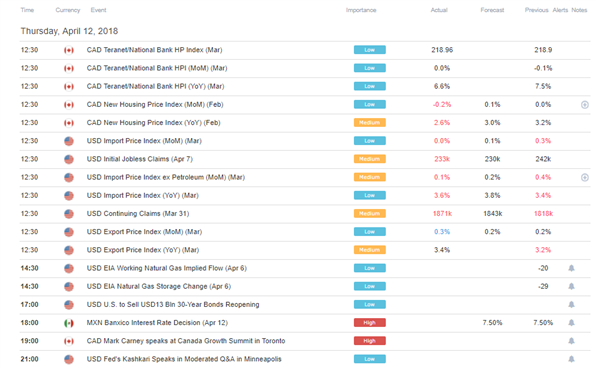

DailyFX Economic Calendar: Thursday, April 12, 2018 – North American Releases

Relatively light today in terms of economic data points, as such, focus will be on headlines which will likely install the most volatility with situation in Syria/Yemen in focus. Trade war concerns have taken a breather since the beginning of the week, with the view that both China and the US will be brought to the negoiation table.

In terms of MXN watchers, 18:00 will see the Banxico interest rate decision, whereby the central bank is expected to stand pat on interest rates, given that the exchange rate has been somewhat stable while inflation has been trending lower.

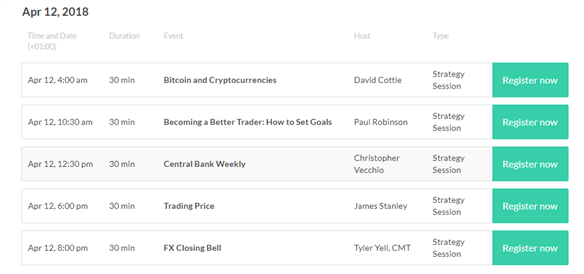

DailyFX Webinar Calendar: Thursday, April 12, 2018

IG Client Sentiment Index Chart of the Day: EURUSD

EURUSD: Data shows 36.0% of traders are net-long with the ratio of traders short to long at 1.78 to 1. The number of traders net-long is 16.2% lower than yesterday and 24.3% lower from last week, while the number of traders net-short is 2.4% higher than yesterday and 11.4% higher from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests EURUSD prices may continue to rise. Traders are further net-short than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger EURUSD-bullish contrarian trading bias.

Learn more about the IG Client Sentiment Index on the DailyFX Sentiment page

Four Things Traders are Reading

- “US Dollar Up, Gold Down as Trump Backtracks on Russia and Syria” by Christopher Vecchio, Senior Currency Strategist

- “Bullish Outlook for Oil Prices Amid Escalating Geopolitical Tensions” by Justin McQueen, Market Analyst

- “EURUSD Looks To Bundesbank’s Weidmann For Hawkish Boost” by Nick Cawley, Market Analyst

- “FTSE Technical Take – Formidable 7300 Level Back in Play” by Paul Robinson, Market Analyst

- “Gold Prices Reverse After Aggressive Breakout into Long-Term Resistance” by James Stanley, Currency Strategist

The DailyFX US AM Digest is published every day before the US cash equity open – you can signup here to receive this report in your inbox every day.

The DailyFX Asia AM Digest is published every day before the Tokyo cash equity open – you can SIGNUP HERE to receive that report in your inbox every day.

If you’re interested in receiving both reports each day, you can SIGNUP HERE.