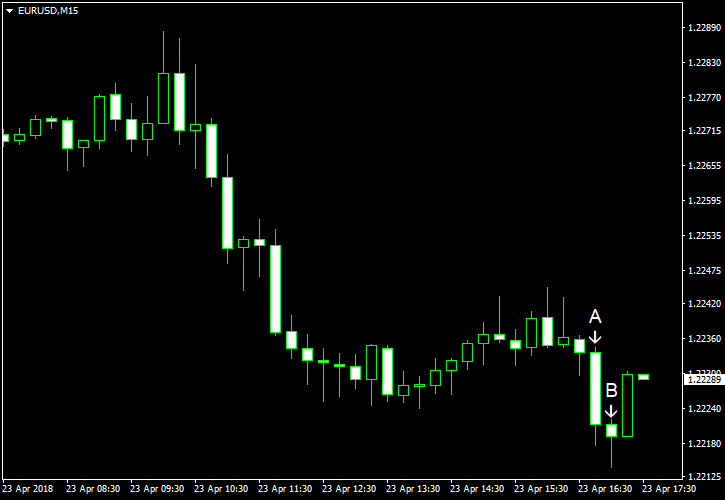

EUR/USD fell today, declining for the third consecutive trading session. Market analysts explained the dollar’s strength by the surging yield for 10-year US Treasuries, though bets on an interest rate hike from the Federal Reserve in June were certainly helping the currency as well. US macroeconomic reports released today were universally positive, giving the greenback yet another reason to rally.

Flash Markit manufacturing PMI climbed from 55.6 in March to 56.5 in April instead of falling to 55.2. as analysts had predicted. Flash Markit services PMI edged up from 54.0 to 54.4. In this instance, analysts managed to be right with their predictions. (Event A on the chart.)

Existing home sales were at the seasonally adjusted annual rate of 5.60 million in March, up from 5.54 million in February. Experts failed to predict the increase, thinking that indicator would stay almost unchanged. (Event B on the chart.)

If you have any comments on the recent EUR/USD action, please reply using the form below.