Receive the DailyFX US AM Digest in your inbox every day before US equity markets open – signup here

US Market Snapshot via IG: DJIA -0.03%, NASDAQ 100 +1.6%, S&P 500 +0.3%

GBP: Post-Brexit highs seem a thing of the past with GBPUSD now off 600pips from 1.4377. The nail is well and truly in the coffin for a May rate hike by the Bank of England after today’s sluggish GDP report for Q1. UK GDP fell to a 2012 low after a 0.2ppt miss at 0.1%, which had been impacted by temporary adverse weather conditions, however the ONS reported that the weather impact had been limited. We will wait for next week’s PMI surveys as to whether the soft data was indeed impacted temporary factors and as such we would see a rebound or if the underlying health of the economy is weak. Nonetheless, today’s report saw GBP immediately pressured, giving up the 1.38 handle amid May rate hike bets plummeting to 20% (Bank of England have never hiked rates when growth has been as low as 0.4%). Mild support set to come in at the March low (1.3711) before the April 2017 trend line support at the 1.3700 handle. EURGBP back towards the high 0.87 area and now looking at a run in for 0.8800, double top set just below at 0.8797 which could keep a lid on further EURGBP gains.

USD: The unwind in the crowded USD short trade continues, DXY on course for its best week since 2016 and now eying the 23.6% Fibonacci retracement of the 2017-2018 fall (103.84-88.19) at 91.88 before a look at 92.00. Rising US yields and monetary policy divergence have helped the USD recovery pick up the pace over the past week as investors raise bets of 3 additional rate hikes (46% from 44% last week). Elsewhere, the USD had been relatively muted despite the better than expected US Q1 GDP figure at 2.3% (Exp. 2.0%), however, this was a slight moderation from the previous of 2.9%.

JPY: Reality check for the Bank of Japan who scrapped the timetable by which they see inflation hitting their 2% price goal in what had largely been a relatively uneventful meeting. As such, a muted reaction seen in JPY, but if there is one thing evident, the BoJ will keep an ultra-loose monetary policy for some time. Elsewhere, overnight saw the historic Korean summit take place, which had been taken positively by the market after North Korea agreed to denuclearize while both North and South Korea will look to sign a peace treaty later this year. Despite the general improvement in sentiment, the safe haven JPY is slightly firmer, largely due to the cross related selling in GBPJPY. However, given the widen US-Japanese yield spreads 110.00 in USDJPY could be on the cards.

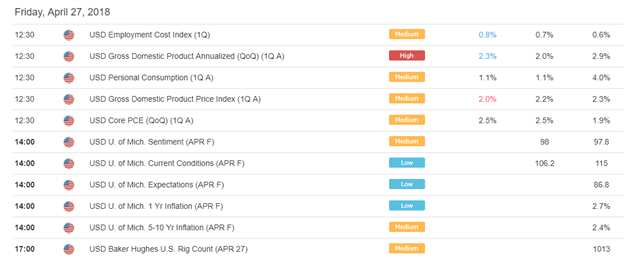

DailyFX Economic Calendar: Friday, April 27, 2018 – North American Releases

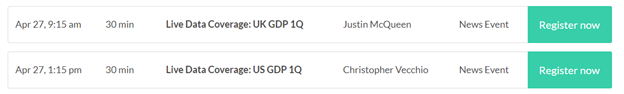

DailyFX Webinar Calendar: Friday, April 27, 2018

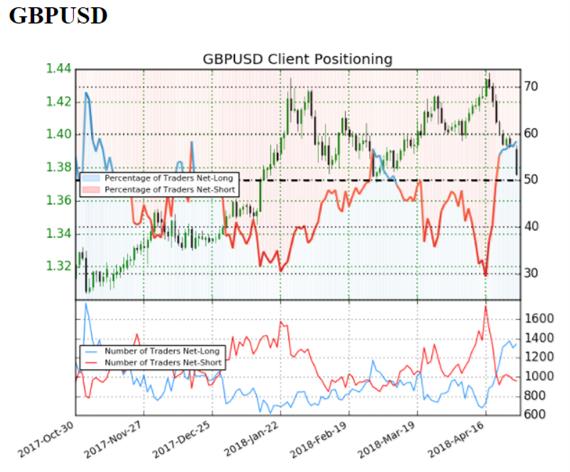

IG Client Sentiment Index Chart of the Day: GBPUSD

GBPUSD: Data shows 58.4% of traders are net-long with the ratio of traders long to short at 1.4 to 1. In fact, traders have remained net-long since Apr 20 when GBPUSD traded near 1.39982; price has moved 1.7% lower since then. The number of traders net-long is 4.2% lower than yesterday and 25.9% higher from last week, while the number of traders net-short is 6.4% lower than yesterday and 13.1% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests GBPUSD prices may continue to fall. Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger GBPUSD-bearish contrarian trading bias.

Learn more about the IG Client Sentiment Index on the DailyFX Sentiment page

Four Things Traders are Reading

- “Traders Unamused by Bullish US GDP Print; DXY Remains Stagnant” by Dylan Jusino, Analyst

- “GBPUSD to Extend Losses After Huge UK GDP Miss” by Martin Essex, MSTA, Analyst and Editor

-

“

US Dollar Nears Short-Term Target; Outlook Remains Bullish”

by Nick Cawley, Market Analyst - “EUR/USD Extends Bearish Sequence Ahead of 1Q U.S. GDP Report” by David Song, Currency Analyst

The DailyFX US AM Digest is published every day before the US cash equity open – you can signup here to receive this report in your inbox every day.

The DailyFX Asia AM Digest is published every day before the Tokyo cash equity open – you can SIGNUP HERE to receive that report in your inbox every day.

If you’re interested in receiving both reports each day, you can SIGNUP HERE.

— Written by Justin McQueen, Market Analyst

To contact Justin, email him at Justin.mcqueen@ig.com

Follow Justin on Twitter @JMcQueenFX