EURUSD talking points:

– Euro-Zone GDP data are not usually a major market mover but the numbers are expected to be weak and that would do nothing to arrest the decline in EURUSD.

– Perhaps the greatest risk is of a sharper than forecast slowdown that would accelerate the pair’s downtrend.

Check out the IG Client Sentiment data to help you trade profitably.

And for a longer-term outlook take a look at our Q2 forecast for EUR.

Trading the news: Euro-Zone GDP at 0900 GMT

EUR at risk of further losses

Euro-Zone GDP data are not generally market-moving in the same way as US or UK GDP figures are but today’s numbers will likely do little to prevent further losses for EURUSD. Hit by both the higher yields on offer in the US and the weakness of Euro-Zone economic growth, the pair has had a torrid couple of weeks.

EURUSD Price Chart, Daily Timeframe (Year to Date)

Chart by IG

Join me for live coverage of the Euro-Zone GDP data at 0845 GMT. You can sign up to this free webinar here.

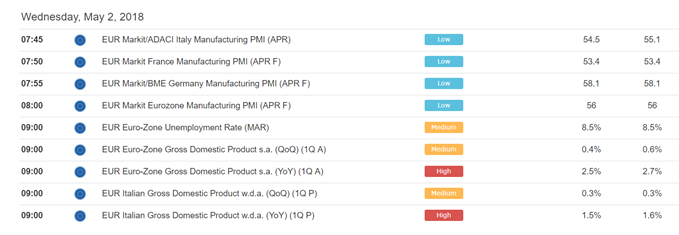

The consensus forecast is for a decline in Euro-Zone economic expansion in the first three months of this year, with analysts predicting GDP growth of 2.5% year/year, down from 2.7% in the final quarter of last year. If the data are weaker than expected, EURUSD is likely to continue falling, while better than predicted numbers could well be shrugged off.

Such a slowdown would follow a period of strong Euro-Zone growth and the sharp falls in EURUSD in recent days have reflected both the signs of a slowdown and the strength of the US Dollar in the wake of rising yields on US Treasury notes and bonds.

In addition, the Euro has suffered from the lack of hawkish commentary from the European Central Bank at the last meeting of its policy-setting Governing Council and from mixed data, with steadier purchasing managers’ indexes offset by weakness in numbers such as German retail sales, which fell for a fourth straight month in March. Sentiment towards the Euro is therefore poor.

Euro-Zone GDP risk

This means that even better-than-expected data are unlikely to arrest the decline in EURUSD even though a slowdown has probably now been fully priced in. Moreover, EURUSD is now trading close to the 1.20 level and the January 9/10 lows at 1.1915 and 1.1923 respectively are the obvious next targets. Any fall through there would take the pair to its lowest levels of the year so far.

Still, if evidence grows of a Q2 pickup, speculation will grow of an ECB decision to taper its bond-buying program to zero in the fourth quarter of the year, perhaps at its meeting in July.

In the meantime, note that Euro-Zone inflation figures for April are due tomorrow. A small fall to 0.9% year/year from 1.0% in March is forecast – taking inflation still further away from the ECB’s target of below but close to 2% and potentially delaying that normalization of the ECB’s monetary policy.

If you’d like to learn how to trade like an expert, you can read our guide to the Traits of Successful Traders.

Some of the key lessons are:

– Successful traders cut losses, and let profits run,

– Successful traders use leverage effectively, and

– Successful traders trade at the right time of day.

For more help to trade profitably listen to our regular Trading Webinars.

— Written by Martin Essex, Analyst and Editor

Feel free to contact me via the comments section below, via email at martin.essex@ig.com or on Twitter @MartinSEssex