Talking Points:

– FOMC holds benchmark interest rate in range of 1.50-1.75%, as was expected by markets.

– Fed funds price in a 100% chance of a 25-bps rate hike in June, but odds for September and December stay in same territory post-release as they did pre-release.

– US Dollar produces mixed reaction, eventually trading lower after a few minutes of initial digestion.

Looking to learn more about how central banks impact FX markets? Check out the DailyFX Trading Guides.

At its May policy meeting today, the Federal Open Market Committee did what was widely expected when they announced the main overnight benchmark rate would stay on hold in the range of 1.50-1.75%. The meeting itself was seen as nothing more than prepping market participants for a 25-bps rate hike next month, when the next Summary of Economic Projections is released.

With that said, there were a few tweaks to the May FOMC policy statement relative to the March one, which in turn suggests the Fed is getting more hawkish on inflation, even as it is getting more dovish on growth.

On inflation, the Fed upgraded its view on prices pressures from “both overall inflation and [core] inflation…have continued to run below 2 percent” to “both overall inflation and [core] inflation…moved close to 2 percent.” Now, “inflation on a 12-month basis is expected to run near the Committee’s symmetric 2 percent objective over the medium term.” The phrase “the Committee is monitoring inflation developments closely” was notably absent.

On growth, the key phrase “the economic outlook has strengthened in recent months,” was removed from the May policy statement. As was the case in the March statement, Fed officials believe that “economic activity will expand at a moderate pace in the medium term and labor market conditions will remain strong.” The release of the Q1’18 US GDP report last week showed growth coming in at +2.3% annualized last quarter, now running below the headline CPI rate of +2.4% (y/y).

See the DailyFX economic calendar for Wednesday, May 2, 2018

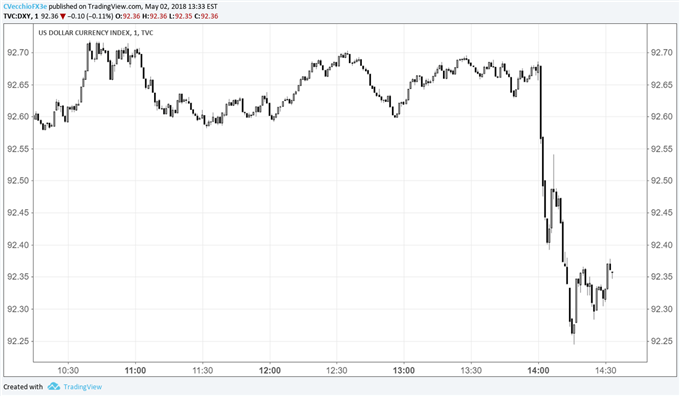

DXY Index Price Chart: 1-minute Timeframe (May 2, 2018 Intraday)

Immediately following the data, the US Dollar slipped back versus the Euro and the Japanese Yen, with the Dollar Index (DXY) dropping from 92.67 ahead of the FOMC decision to as low as 92.25. The DXY Index was trading at 92.36 at the time this report was written.

Read more: US Dollar Outlook for the May FOMC Meeting

FX TRADING RESOURCES

Whether you are a new or experienced trader, DailyFX has multiple resources available to help you: an indicator for monitoring trader sentiment; quarterly trading forecasts; analytical and educational webinars held daily; trading guides to help you improve trading performance, and even one for those who are new to FX trading.

— Written by Christopher Vecchio, CFA, Senior Currency Strategist

To contact Christopher Vecchio, e-mail cvecchio@dailyfx.com

Follow him on Twitter at @CVecchioFX

To be added to Christopher’s e-mail distribution list, please fill out this form