GBPUSD Analysis and News

- GBP falls following the Bank of England’s 7-2 neutral hold; Inflation and GDP forecasts lowered

- Market Pricing for an August Rate Hike Falls to 42% from 62% prior to announcement

For a more in-depth analysis on Sterling, check out the Q2 Forecast for GBP/USD

GBP Bulls Left Disappointed

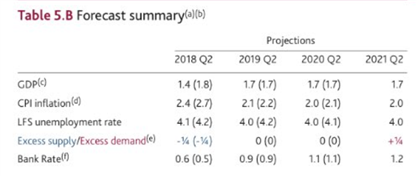

GBP Bulls left well and truly disappointed after the Bank of England Quarterly Inflation Report with GBPUSD falling from 1.3600 to a low of 1.3509, while the FTSE 100 and Gilts rose to intra-day highs. The BoE had left the bank rate unchanged at 0.5% with McCafferty and Saunders the typical hawkish dissenters, while inflation and GDP forecasts had been lowered amid the soft start to 2018.

Bank of England Forecast

Source: Bank of England

Rate Hike Bets Unwind

The MPC stated that the slowing in Q1 GDP growth had been overstated in the prelim release and believed that over time Q1 will be revised higher to 0.3% and thereafter look for 0.4% in Q2, while noting that CPI appeared to have peaked with theimpact of GBP depreciation likely to fade a little faster than previously thought. Following these comments, OIS markets saw an unwind of rate hike bets with the August meeting now seen at a 42% chance from 62% prior to the release, while a full 25bps rate hike is now not seen in 2018 with the central bank reiterating that any rate hikes will be gradual and limited.

GBP/USDPRICE CHART 1: 1-MINUTE TIME FRAME (MAY 10th)

See how retail traders are positioning in GBPUSD as well as other major FX pairs on an intraday basis using the DailyFX speculative positioning data on the sentiment page.

— Written by Justin McQueen, Market Analyst

To contact Justin, email him at Justin.mcqueen@ig.com

Follow Justin on Twitter @JMcQueenFX