EURUSD News and Talking Points

– The two parties are close to agreeing a government although the choice of Prime Minister is still undecided.

– EURUSD looks to be capped despite a slightly weaker greenback.

The DailyFX Q2 Trading Forecasts for all major currencies, commodities and indices, are now availableto download to help you make more informed trading decisions.

EURUSD May Struggle to Move Higher

The news that the Italian Five Star Movement and the Northern League are close to agreeing a new government will have been watched closely by Brussels as the populist movement in the Euro-Zone’s third-largest country gathers further momentum. A new government is likely to cut taxes and pension reforms and is also said to be looking at issuing a quasi-parallel currency, putting it at squarely at odds with the European Union. The Northern League leader Matteo Salvini in the past has said that Italy should break free from the EU’s austerity measures and ignore the bloc’s 3% budget deficit limit.

The single currency looks set to be capped in the short-term against the US dollar despite the greenback slipping back due to lower US Treasury yields. With the closely followed 10-year UST yield unable to make a clean break above 3%, the greenback has drifted lower in the last few trading sessions. Any EURUSD upside however is likely capped at the 200-day moving average around 1.20510 and a small gap on the May 1 candle between 1.20300 and 1.20600.

The latest IG Client Sentiment Indicatorshows 56.3% of traders are net-long EURUSD with the ratio of traders long to short at 1.29 to 1 with short positions in the pair being reduced

recently. Download the free data to see how positional changes can affect trading decisions.

EURUSD Price Chart Daily Timeframe (July 2017 – May 14, 2018)

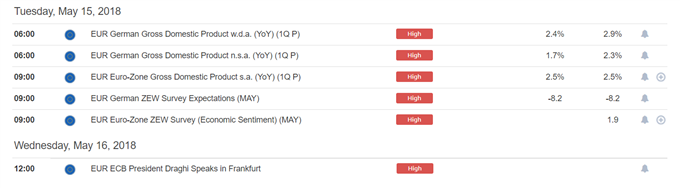

Traders should also be aware of the high-importance Euro-Zone and German data being released on Tuesday and ECB President Mario Draghi’s speech on Wednesday at 12:00 GMT.

If you are new to foreign exchange, or if you would like to update your knowledge base, download our New to FX Guide and our Traits of Successful Traders to help you on your journey.

What’s your opinion on the EURUSD? Share your thoughts with us using the comments section at the end of the article or you can contact the author via email at Nicholas.cawley@ig.com or via Twitter @nickcawley1

— Written by Nick Cawley, Analyst