Receive the DailyFX US AM Digest in your inbox every day before US equity markets open – signup here

US Market Snapshot via IG: DJIA +0.3%, Nasdaq 100 +0.2%, S&P 500 +0.2%

Major Headlines

- Italy’s President is to hold formation talks with 5-Star/League at 1630/1800GMT

- ECB’s Villeroy says QE is near end and hikes will be discussed after

- OPEC crude production rose 12k in April to average 31.93mln bpd

EUR: The Euro found a bid this morning and is among today’s best performers in the G10 FX space following tightening chatter from ECB’s Villeroy who stated that the end of QE is nearing after which the ECB can give guidance on interest rate hikes. Subsequently, EURUSD made a run in on the 1.2000 handle where selling interest ahead keeps further upside capped for now. Additionally, the 200DMA at 1.2020 is also likely to act as resistance provided EURUSD pushes through 1.2000. The Euro seemingly unfazed by a populist party governing Italy with German and Italian 10yr bond spreads in fact tightening this morning.

GBP: USD softness keeping GBP afloat above 1.3550, failed to break topside resistance at 1.3600, eyes will be on tomorrows Employment report which will guide price action in the near-term given Sterling’s heightened data dependency. These relatively low levels also seemingly attractive for long-term GBP bulls following its recent pounding.

USD: The recent rapid rise in the USD recovery has seemingly run out of steam, DXY continuing to reel from last week’s disappointing CPI report (core readings missed estimates), which has reigned in bets for a 4th rate hike this year. Tomorrows retail sales report may offer little in terms of volatility and as such, the easing of the USD strength may well continue throughout the week.

DailyFX Economic Calendar: Monday, May 14, 2018 – North American Releases

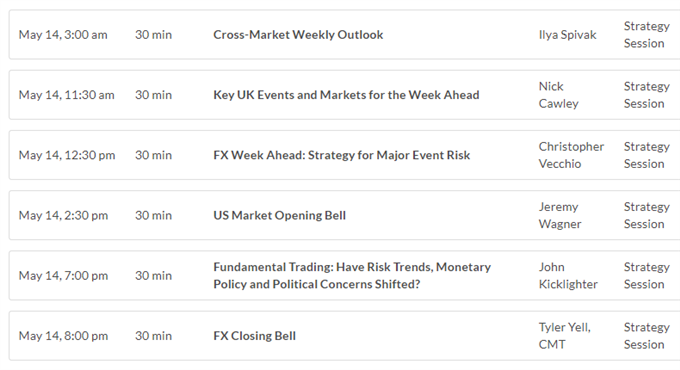

DailyFX Webinar Calendar: Monday, May 14, 2018

IG Client Sentiment Index: EURUSD Chart of the Day

EURUSD: Data shows 56.3% of traders are net-long with the ratio of traders long to short at 1.29 to 1. In fact, traders have remained net-long since Apr 30 when EURUSD traded near 1.19892; price has moved 0.6% lower since then. The number of traders net-long is 0.2% lower than yesterday and 6.9% higher from last week, while the number of traders net-short is 9.4% lower than yesterday and 9.7% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests EURUSD prices may continue to fall. Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger EURUSD-bearish contrarian trading bias.

Five Things Traders are Reading

- “Euro Forecast: EUR/USD Weakness Can Resume if EZ CPI Declines Again” by Christopher Vecchio, Senior Currency Strategist

- “UK Market Look Ahead – Is Sterling Oversold? | Webinar” by Nick Cawley, Market Analyst

- “Attractive Levels for GBPUSD Bulls” by Justin McQueen, Market Analyst

- “CoT: USD/CHF Bearish on Swiss Franc Position Changes, Technicals” by Paul Robinson, Market Analyst

- “EURUSD Capped as Italian Populist Government Takes Shape” by Nick Cawley, Market Analyst

The DailyFX US AM Digest is published every day before the US cash equity open – you can signup here to receive this report in your inbox every day.

The DailyFX Asia AM Digest is published every day before the Tokyo cash equity open – you can SIGNUP HERE to receive that report in your inbox every day.

If you’re interested in receiving both reports each day, you can SIGNUP HERE.

— Written by Justin McQueen, Market Analyst

To contact Justin, email him at Justin.mcqueen@ig.comFollow Justin on Twitter @JMcQueenFX