- December 21, 2020 Do we get tax benefits on Personal Loan?

- December 18, 2020 The solicitors Preston depends on for stress-free compensation claims

- December 16, 2020 eToro: History and Key Features

- December 11, 2020 Canadian Dollar Pauses 2020 Rally Against US Peer Amid Falling Crude Prices

- December 11, 2020 Pound Crashes Against Dollar As No-Deal Brexit Appears Imminent

- December 11, 2020 USD/JPY 104.57 High Starting a New Bearish Leg?

Day: May 17, 2018

May 17

May 172018

Canadian Dollar Stable After Domestic Economic Releases

The Canadian dollar was stable today following economic releases over the current trading session and ahead of important economic reports due to release tomorrow. Automatic Data Processing reported that Canada’s employment rose by 30,198 in April, while the March increase got a significant positive revision from 42,800 to 59,300. According to Statistics Canada, foreign investment in Canadian securities was at C$6.15 billion in March, up from C$4.32 billion in February […]

Read more May 17

May 172018

Sterling Trims Gains As May Denies Plans to Stay in Customs Union

The Great Britain pound rallied today amid reports that the United Kingdom seeks to remain in the customs union after it leaves the European Union. The currency retreated a bit after Britain’s Prime Minister Theresa May denied such plans, though the sterling remained firmly above the opening level. Earlier today, The Telegraph reported that Britain will stay in the customs union beyond 2021. That resulted in a rally of the pound. Yet […]

Read more May 17

May 172018

GBPUSD Is Not Yet Ready To Rally

GBP talking points: – First it was reported that the UK is ready to stay in the EU customs union beyond 2021. – Then UK Prime Minister Theresa May denied the report. – The lack of response in GBPUSD suggests that a move higher to recover a substantial percentage of the past month’s losses is […]

Read more May 17

May 172018

Oil Price Forecast Remains Bullish as Saudi Arabia Hits $80 Price Target

Oil Price Analysis and News Brent crude futures hit Saudi Arabia’s $80 target. Rising geopolitical tensions to keep oil prices elevated CADJPY offers upside value, EURNOK selling attractive For a more in-depth analysis on Oil Prices, check out the Q2 Forecast for Oil Saudi Arabia Hits $80 Price Target A month on from when the […]

Read more May 17

May 172018

Trade War: No Respite for EURUSD as US-China Trade Talks Resume

Trade talking points: – The potential for a trade war continues to be a major influence on the FX markets as US-China trade talks resume in Washington. – So far, that has done little to help EURUSD, which could well extend its recent losses. Check out the IG Client Sentiment data to help you trade […]

Read more May 17

May 172018

US AM Digest: Oil Prices Rise to $80 for the First Time Since 2014

Receive the DailyFX US AM Digest in your inbox every day before US equity markets open – signup here US Market Snapshot via IG: DJIA -0.1%, Nasdaq 100 -0.4%, S&P 500 -0.2% Major Headlines Brent Oil hits $80 for the first time since November 2014 UK press reports that UK is considering remaining in Custom […]

Read more May 17

May 172018

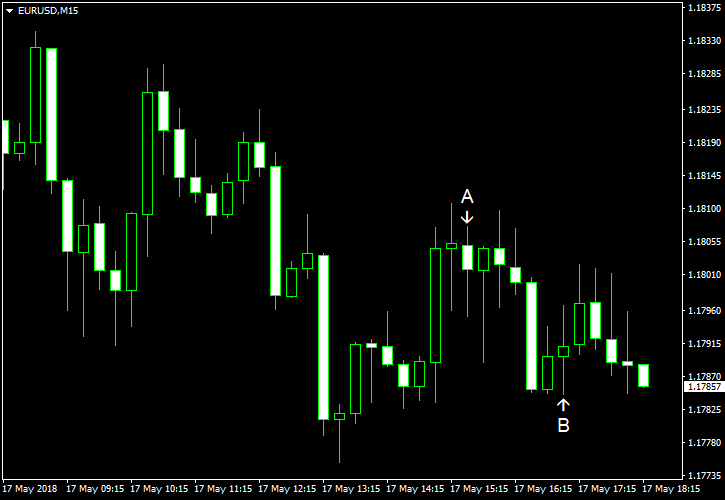

US Treasury Yields Continue to Push EUR/USD Lower

EUR/USD fell today, extending its decline for the fourth consecutive trading session, as persistently firm US Treasury yields continued to bolster the US dollar. Macroeconomic data released in the United States over the current session was good for the most part, with the exception of unemployment claims that rose more than was expected. Initial jobless claims climbed from 211k to 222k last week, exceeding market expectations of 216k. (Event […]

Read more May 17

May 172018

NZ Dollar Fails to Rally, Trades Near Opening

The New Zealand dollar behaved somewhat similarly to its Australian counterpart today, attempting to rally intraday, but losing gains by now. Statistics New Zealand reported that the input Producer Price Index rose 0.6% in the March quarter from the previous three months, slowing from the 0.9% rate of growth registered in the previous quarter but beating expectations of a 0.3% increase. The output PPI rose 0.2%, in line with expectations but […]

Read more May 17

May 172018

Aussie Rallies After Mixed Employment Data, Struggles to Keep Gains

The Australian dollar attempted to rally intraday but has trimmed its gains against most major rivals by now and lost them versus the US dollar entirely. The rally followed employment data, which actually was somewhat mixed. According to the report from the Australian Bureau of Statistics, Australia’s employers added 22,600 jobs in April, beating the average forecast of 19,800. Furthermore, the increase was a result of growth in full-time employment, while part-time […]

Read more May 17

May 172018

Australian Dollar Still Stuck Despite Strong Employment Data

Australian Dollar, Labour Market Data, Talking Points Australian employment levels overall beat forecasts for April Full-time positions grew strongly while part-time ones shrank Still, Aussie rates aren’t forecast to move for many months yet Find out what retail foreign exchange traders make of the Australian Dollar’s prospects right now at the DailyFX Sentiment Page The […]

Read more