Receive the DailyFX US AM Digest in your inbox every day before US equity markets open – signup here

US Market Snapshot via IG: DJIA -0.1%, Nasdaq 100 -0.4%, S&P 500 -0.2%

Major Headlines

- Brent Oil hits $80 for the first time since November 2014

- UK press reports that UK is considering remaining in Custom Union beyond 2020, however later refuted by PM May.

USD: The US Dollar continues to press for better levels across the board with EUR and GBP teetering on 1.18 and 1.35 respectively, while also looking to take on 111.00 against JPY. US yields march on, 10yr now yielding over 3.10% after breaking above the taper tantrum high of 3.05%, markets placing greater emphasis on rate differentials, widening US-JP 10yr bond spread likely to support USDJPY through 111.00. DXY keeps the December high of 94.22 within its sight.

GBP: Strength in GBP this morning on the back of reports from the Telegraph that the UK is considering remaining in the Custom Union beyond 2020 suggests that GBP gains are closely aligned to the status quo. However, GBP did pare some of the initial bid after PM May downplayed the reports from the Telegraph and reiterated that the UK will exit the Customs Union, as such, the risk of a hard Brexit will keep the pressure on the Pound.

Oil: A month after Saudi Arabia imply that they would prefer $80, the OPEC kingpin finally hits its price target with geopolitical risks the largest driver of the bullish price action. The upcoming election in Venezuela will also be of interest to oil traders given potentially retaliation from the US who have stated that the election is unfair, full analysis click here. Yesterday’s EIA report helped oil find a bid, US crude inventories fell by 1.4mln, while exports rose 700k to 2.57mln bpd, highest weekly reading on record. As a result, net oil imports fell to the second lowest level in 18yrs. Room for further upside, according to the option market, with the most active call option in Brent crude at $90 for September contract and $100 for the December contract.

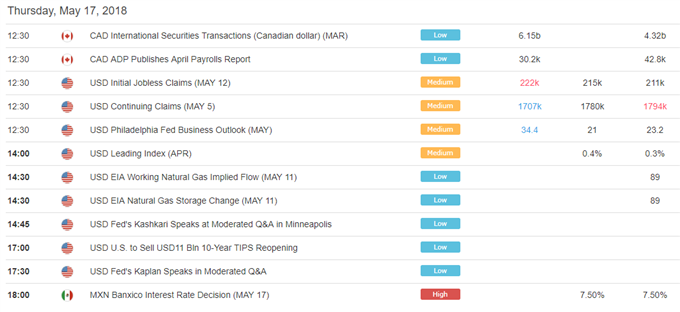

DailyFX Economic Calendar: Thursday, May 17, 2018 – North American Releases

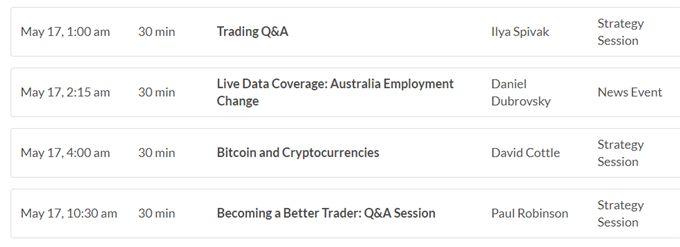

DailyFX Webinar Calendar: Thursday, May 17, 2018

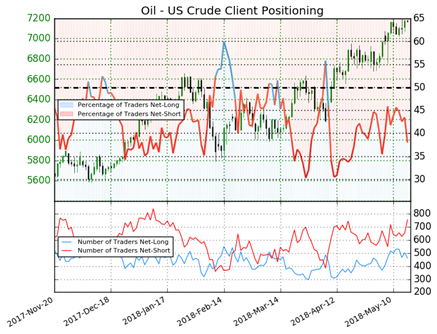

IG Client Sentiment Index: Oil Price Chart of the Day

Oil – US Crude: Data shows 38.0% of traders are net-long with the ratio of traders short to long at 1.63 to 1. In fact, traders have remained net-short since Apr 09 when Oil – US Crude traded near 6312.4; price has moved 13.6% higher since then. The percentage of traders net-long is now its lowest since May 08 when it traded near 7057.7. The number of traders net-long is 1.9% lower than yesterday and 11.8% lower from last week, while the number of traders net-short is 18.7% higher than yesterday and 14.2% higher from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests Oil – US Crude prices may continue to rise. Traders are further net-short than yesterday and last week, andthe combination of current sentiment and recent changes gives us a stronger Oil – US Crude-bullish contrarian trading bias.

Four Things Traders are Reading

- “here” by Justin McQueen, Market Analyst

- “Ethereum Has Healthiest Chart Among Group, Watch Proven Support”by Paul Robinson, Market Analyst

- “GBPUSD Is Not Yet Ready To Rally”by Martin Essex, MSTA, Analyst and Editor

- “US China Trade War & a Brief History of Trade Wars – 1900 until Present”by John Kicklighter, Ilya Spivak, Christopher Vecchio and Renee Mu

The DailyFX US AM Digest is published every day before the US cash equity open – you can signup here to receive this report in your inbox every day.

The DailyFX Asia AM Digest is published every day before the Tokyo cash equity open – you can SIGNUP HERE to receive that report in your inbox every day.

If you’re interested in receiving both reports each day, you can SIGNUP HERE.

— Written by Justin McQueen, Market Analyst

To contact Justin, email him at Justin.mcqueen@ig.comFollow Justin on Twitter @JMcQueenFX