EUR/USD fell today, extending its decline for the fourth consecutive trading session, as persistently firm US Treasury yields continued to bolster the US dollar. Macroeconomic data released in the United States over the current session was good for the most part, with the exception of unemployment claims that rose more than was expected.

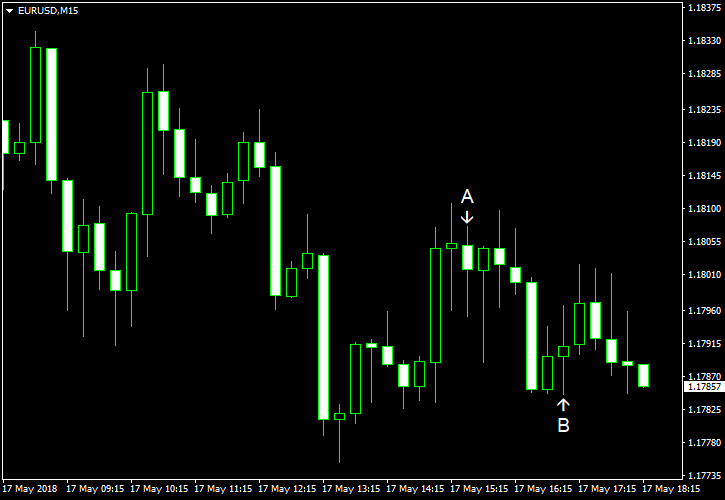

Initial jobless claims climbed from 211k to 222k last week, exceeding market expectations of 216k. (Event A on the chart.)

Philadelphia Fed manufacturing index jumped from 23.2 in April to 34.4 in May instead of falling to 21.1 as analysts had predicted. (Event A on the chart.)

Leading indicators rose 0.4% in April, the same as in March and matching forecasts. (Event B on the chart.)

If you have any comments on the recent EUR/USD action, please reply using the form below.