– Lower consumer prices push back potential UK rate hikes.

– GBP hits a five-month low against the USD: next up the FOMC.

The IG Client Sentiment Report shows that traders are just over 70% long GBPUSD – a bearish contrarian signal – although current changes give us a mixed trading bias.

GBP Continues to Fall with Interest Rate Hikes Being Kicked Down the Road.

UK inflation continues to move lower, with annual CPI falling to 2.4% in April against a prior months, and expectations of, 2.5%. The Bank of England’s preferred choice of inflation, CPIH fell to 2.2% from 2.3% in March. Inflation fell despite the recent surge in the oil price.

Commenting on today’s inflation figures, ONS Head of Inflation Mike Hardie said:“Inflation continued to slow in April, with air fares making the biggest downward contribution, due to the timing of Easter. This was partially offset by the rise in petrol prices. He added, “annual price growth for goods leaving factories was unchanged in April. However, the cost of raw materials increased, mainly driven by strong rises in crude oil prices.”

The slight fall in UK consumer prices will buoy the doves on the Bank of England’s MPC and keep interest rates lower-for-longer. While some analysts are looking at the August MPC meeting for a 0.25% rate hike, any further falls in inflation will push these expectations back to November. UK growth, currently at a quarterly rate of 0.1% will also need to pick up strongly before the hawks in the BOE take control.

On the chart, 1.33018 is the first downside target ahead of a heavier fall to 1.30272, the October 6 swing low. Moves to the upside will be met with resistance at 1.34581, the January 11 low print. It is worth noting the GBPUSD continues to sit in oversold territory according to the RSI indicator at the bottom of the chart.

This evenings’s FOMC meeting will draw greater attention for GBPUSD investors as well with the US dollar continue to move higher.

GBPUSD Daily Price Chart (April 20, 2017 – May 23, 2018)

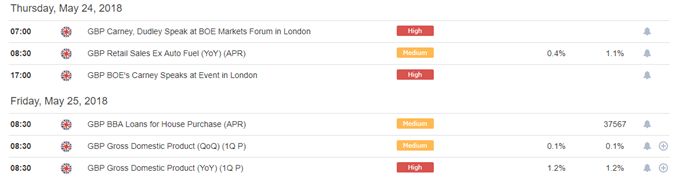

Looking ahead, UK retail sales data on Thursday and the second look at UK Q1 GDP will also help shape sterling moves, while also early Thursday BOE governor Mark Carney and New York Fed president William Dudley will speak at the BOE Markets Forum in London.

Traders may also be interested in two of our trading guides – Traits of Successful Traders and Top Trading Lessons – while technical analysts may be interested in our latest Elliott Wave Guide.

— Written by Nick Cawley, Analyst

To contact Nick, email him at nicholas.cawley@ig.com

Follow Nick on Twitter @nickcawley1