Receive the DailyFX US AM Digest in your inbox every day before US equity markets open – signup here

US Market Snapshot via IG: DJIA 0.7%, Nasdaq 100 0.5%, S&P 500 0.6%

Major Headlines

- German Inflation rises to 2.2% due to higher oil prices

- US Q1 GDP and ADP Employment Change missed expectations

- Italy look set for another election

EUR: Relief rally is among the factors that have helped the Euro find a bid this morning and reclaim the 1.16 handle. Aside from this, German data has been somewhat encouraging with the unemployment rate falling to a record low of 5.1%, while inflation has also ticked up with the headline reading above the ECB’s 2% target at 2.2%. However, this is largely supported by the rise in energy prices other the past month, underlying inflation is of greater importance for the ECB. Although jitters over Italy have eased this morning, prompting a lift in the Euro, uncertainty remains with Italy likely heading for another election. Yesterday’s high at 1.1640 keeping a lid on gains for now.

USD: The Dollar is losing some ground today and looking somewhat overextended above 94.20. Additionally, GDP figures underwhelmed expectations keeping the greenback offered, while trade war talk is starting to crank up again, following reports that the US is to go ahead of $50bln worth of import tariffs on China. As such, an escalation of this from China will likely suppress the greenback in the near-term.

CAD: All eyes on the Bank of Canada meeting at 14:00GMT, where the central bank is expected to keep rates unchanged. Focus will be on the accompanying statement in which investors will be looking whether to re-price a summer rate hike (60% priced in for a July hike). Option market vols suggest break-evens are at 90pips.

DailyFX Economic Calendar: Wednesday, May 30, 2018 – North American Releases

DailyWebinar Calendar: Wednesday, May 30, 2018

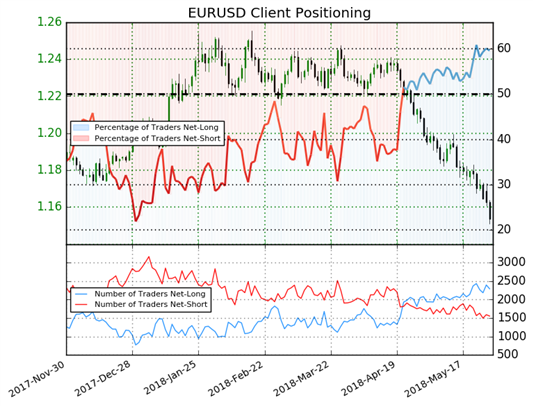

EURUSD: Data shows 59.6% of traders are net-long with the ratio of traders long to short at 1.47 to 1. In fact, traders have remained net-long since Apr 30 when EURUSD traded near 1.21041; price has moved 4.7% lower since then. The number of traders net-long is 3.0% lower than yesterday and 3.7% lower from last week, while the number of traders net-short is 6.0% lower than yesterday and 13.8% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests EURUSD prices may continue to fall. Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger EURUSD-bearish contrarian trading bias.

Four Things Traders are Reading

- “EUR/USD Price Reverses Sharp Decline as Italian Fears Cool” byChristopher Vecchio, CFA , Sr. Currency Strategist

-

“

Cryptocurrency Price Analysis: Trading Ranges | Webinar”

by Nick Cawley, Market Analyst - “Trading Outlook – USD, Euro, Pound, AUD/NZD and More”by Paul Robinson , Market Analyst

- “Preview: Bank of Canada Interest Rate Seen on Hold Amid Rising NAFTA Concerns” by Justin McQueen, Market Analyst

The DailyFX US AM Digest is published every day before the US cash equity open – you can signup here to receive this report in your inbox every day.

The DailyFX Asia AM Digest is published every day before the Tokyo cash equity open – you can SIGNUP HERE to receive that report in your inbox every day.

If you’re interested in receiving both reports each day, you can SIGNUP HERE.

— Written by Justin McQueen, Market Analyst

To contact Justin, email him at Justin.mcqueen@ig.comFollow Justin on Twitter @JMcQueenFX