EURUSD analysis and talking points:

– EURUSD has been hit hard by political turmoil in Italy and Spain, as well as possible US tariffs on EU steel and aluminum.

– However, after the initial adjustment lower, a period of relative stability is likely as markets tend to settle after an initial strong move downwards.

Check out the IG Client Sentiment data to help you trade profitably.

And for a longer-term outlook take a look at our Q2 forecast for EUR.

Euro set to stabilize after bounce from 10-month low

EURUSD has been hit hard over the past six weeks, falling to a 10-month low on a strong US Dollar, political upheaval in Italy and Spain, and the threat of US tariffs on EU steel and aluminum. However, the rally that began on Wednesday suggests that a period of relative stability is on the way given that markets tend to settle down once an initial shock has been priced in – as these latest concerns seem to have been.

EURUSD Price Chart, Daily Timeframe (Year to Date)

The list of concerns for EURUSD is a long one: the US economy is healthier than the EU’s, putting upward pressure on US interest rates that are already higher than in the EU; Italy could yet face a snap election bringing Eurosceptics into power; Spain’s prime minister is facing a no-confidence vote in Congress; and Washington is set to announce plans to impose tariffs on EU steel and aluminum imports.

However, EURUSD has already rallied from the lows and arguably the bad news has now been priced in to the Euro, stocks and bonds, suggesting at least a temporary respite. News of higher-than-expected inflation in the Euro-Zone in May should also support the Euro, making it easier for the European Central Bank to end its monetary stimulus program.

Technically, EURUSD is facing chart resistance that could impede a stronger rally but retail investor sentiment data point to further gains, together making a period of sideways trading the most likely outcome, at least for a while.

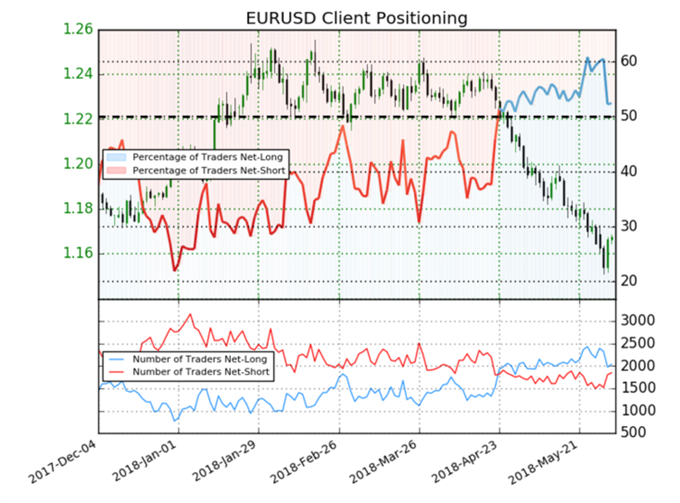

The retail trader data show 52.5% of traders are net-long, with the ratio of traders long to short at 1.1 to 1. In fact, traders have remained net-long since April 30, when EURUSD traded near 1.2129; the price has moved 3.7% lower since then. The number of traders net-long is 12.7% lower than yesterday and 16.2% lower from last week, while the number of traders net-short is 20.2% higher than yesterday and 18.6% higher from last week.

At DailyFX, we typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests EURUSD may resume its fall. Yet traders are less net-long than yesterday and compared with last week. Recent changes in sentiment warn that the current EURUSD price trend may soon rallyfurther despite the fact traders remain net-long.

Resources to help you trade the forex markets

Whether you are a new or an experienced trader, at DailyFX we have many resources to help you: analytical and educational webinars hosted several times per day, trading guides to help you improve your trading performance, and one specifically for those who are new to forex. You can learn how to trade like an expert by reading our guide to the Traits of Successful Traders.

— Written by Martin Essex, Analyst and Editor

Feel free to contact me via the comments section below, via email at martin.essex@ig.com or on Twitter @MartinSEssex