- December 21, 2020 Do we get tax benefits on Personal Loan?

- December 18, 2020 The solicitors Preston depends on for stress-free compensation claims

- December 16, 2020 eToro: History and Key Features

- December 11, 2020 Canadian Dollar Pauses 2020 Rally Against US Peer Amid Falling Crude Prices

- December 11, 2020 Pound Crashes Against Dollar As No-Deal Brexit Appears Imminent

- December 11, 2020 USD/JPY 104.57 High Starting a New Bearish Leg?

Day: June 12, 2018

June 12

June 122018

British Pound Rallies Higher on Mixed UK Jobs Data and Brexit Vote

The British pound today rallied higher following the release of the latest UK employment report, which had mixed results. The GBP/USD currency pair later gave up most of its gains, but rallied higher in the American session as the UK Parliament voted on a crucial Brexit bill. The GBP/USD currency pair today rallied from a low of 1.3340 to an intra-day high of 1.3419 after the jobs report, before declining for a few hours then rallying […]

Read more June 12

June 122018

GBP Boosted by Robust UK Jobs Data; Inflation, Brexit Loom | Webinar

GBP Latest News and Analysis UK jobs market continues to hit multi-decade unemployment lows. Wages data shows price pressures are not yet visible. Inflation data and Brexit vote will now steer GBP over the next two days. The latest IG Client Sentiment Report shows that while retail remain long of GBPUSD – normally a contrarian […]

Read more June 12

June 122018

Global Trade Wars Weigh on German Sentiment which Falls to Sep 2012 Low

EUR Analysis and Talking Points Trade Wars see German Investor Sentiment Plunge to Sep 2012 low ZEW notes that the German Outlook has Significantly Deteriorated Over the Next 6 Months See our Q2 EUR forecast to learn what will drive the currency through the quarter. Economic Outlook Worsens The Euro and DAX saw a muted […]

Read more June 12

June 122018

GBPUSD Testing Downside as Brexit Votes Loom

GBP news and analysis: – The UK Government faces a testing week in the House of Commons as lawmakers vote on a series of amendments to the EU withdrawal bill. – If any of the amendments to the bill passed by the House of Lords are also passed by the Commons that would destabilize the […]

Read more June 12

June 122018

Financial Market Sentiment Turns Positive | Webinar

Market confidence news and analysis: – Sentiment in the financial markets is improving, with riskier assets in demand and safe havens out of fashion. – In this webinar, DailyFX Analyst and Editor Martin Essex discussed the most important factors affecting confidence in the markets. Check out the IG Client Sentiment data to help you trade […]

Read more June 12

June 122018

Ripple (XRP) and Litecoin (LTC) Price Charts: Dead Cat Bounce?

Ripple and Litecoin Prices, Analysis and Charts – Little rebound seen in major cryptocurrencies after recent heavy losses. – Ripple and Litecoin may struggle to make any headway on ominous charts. IG Client Sentimentshows how clients are currently positioned in Ripple and Litecoin and how sentiment has changed over the last week. Ripple (XRP) and […]

Read more June 12

June 122018

US AM Digest: USD Muted Despite Inflation Rising to 6-yr Highs, GBP Eyes Brexit Vote

US Market Snapshot via IG: DJIA 0.1%, Nasdaq 100 0.1%, S&P 500 0.1% Major Headlines Historic Summit Between President Trump and Kim Jong Un leads to denuclearisation deal UK Labour Market Remains Robust Despite Miss in Average Earnings German Investor Morale Falls on Sep 2012 Low on Trade War Concerns US Inflation prints in-line with […]

Read more June 12

June 122018

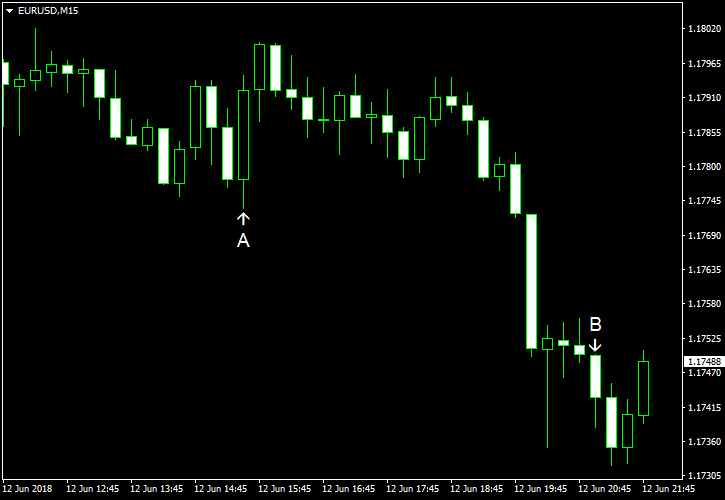

EUR/USD Higher Ahead of FOMC Meeting

EUR/USD rallied today as traders were anticipating that the Federal Open Market Committee will announce an interest rate hike tomorrow. Today’s strong inflation data supported such outlook. The European Central Bank and the Bank of Japan will also make policy announcement later this week. Meanwhile, the meeting between the US and North Korean leaders ended with a pledge of friendship and steps toward denuclearization of the Korean peninsula, putting markets […]

Read more June 12

June 122018

Asian Shares Cautiously Higher, Await Details on Trump/Kim Summit

Asian Stocks Talking Points: Asian shares cautiously higher as US and North Korea summit took place in Singapore Signs of peace but no answers on denuclearization may have kept stocks from more gains The markets still await more details to come. AUD/USD is wedged between key levels Find out what retail traders’ Australian Dollar buy […]

Read more June 12

June 122018

Asia AM Digest: Stocks and FX Eye Trump/Kim Singapore Summit

Current Market Developments – Stocks Higher, Late Oil Rally Halts Loonie’s Depreciation Optimism has cautiously prevailed in the global stock markets on Monday after US President Donald Trump left the G7 summit and deepened tensions with the present nations, especially Canada. Stocks outperformed in Europe and Wall Street was left slightly higher. The S&P 500 […]

Read more