US Market Snapshot via IG: DJIA 0.05%, Nasdaq 100 0.1%, S&P 500 0.05%

Major Headlines

- UK Inflation remains at 1yr low of 2.4%

- President Trump states oil prices are too high

- Markets await FOMC decision

GBP: Inflation in the UK remained at 2.4% in May, below expectations of 2.5%. As such, this has led to a further unwind of BoE rate hike expectations with an August rate hike seen at 41%., down from 45%. Subsequently, GBP has remained under pressure to hover around the low 1.33s, while the UK parliament vote over the EU withdrawal bill will also likely keep a lid on GBP gains. EURGBP looking to make another retest towards 0.8830-40, break above could open up channel towards 0.89.

USD: A relatively muted affair in FX markets ahead of the FOMC rate decision, in which the central bank is expected to deliver a 25bps hike to the Federal Fund Rate to 1.75-2%. However, the focus will be on the Fed Dot Plot projections where an upgrade to 4 2018 rate hikes could see the USD supported. A disappointment by the Fed to meet the high expectations of a hawkish hike would likely see a sharp reversal vs. the Euro and JPY.

Reminder: DailyFX Chief Currency Strategist John Kicklighter will be covering the FOMC Meeting Live from 1745GMT.

EUR: The Euro is also in focus before the ECB meeting scheduled tomorrow. A slight short squeeze observed this morning with EURUSD back towards best levels of the day at 1.1770. However, price action has been somewhat muted ahead the key central bank risk events. EURUSD dismissed the another bearish report out of the Euro-Area with industrial production falling short of analyst expectations.

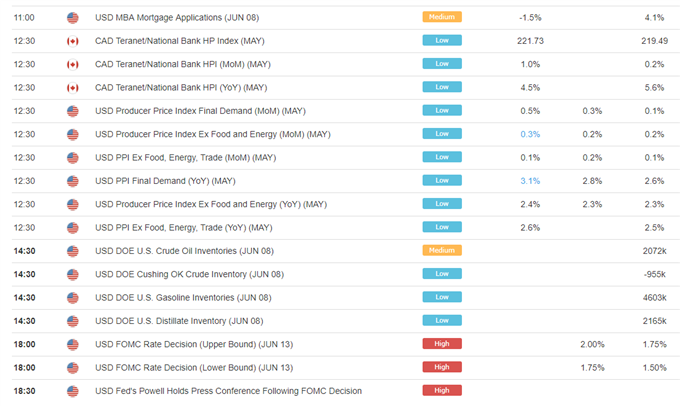

DailyFX Economic Calendar: Wednesday, June 13, 2018 – North American Releases

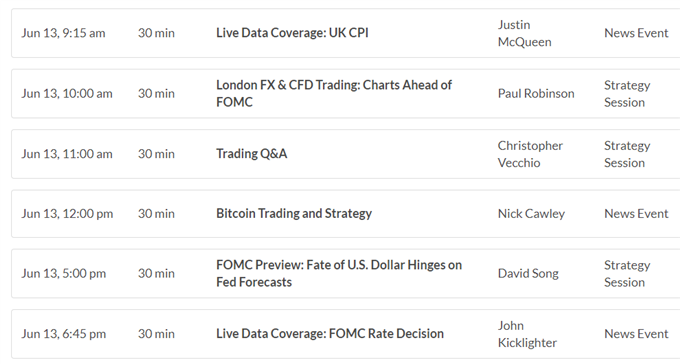

DailyWebinar Calendar: Wednesday, June 13, 2018

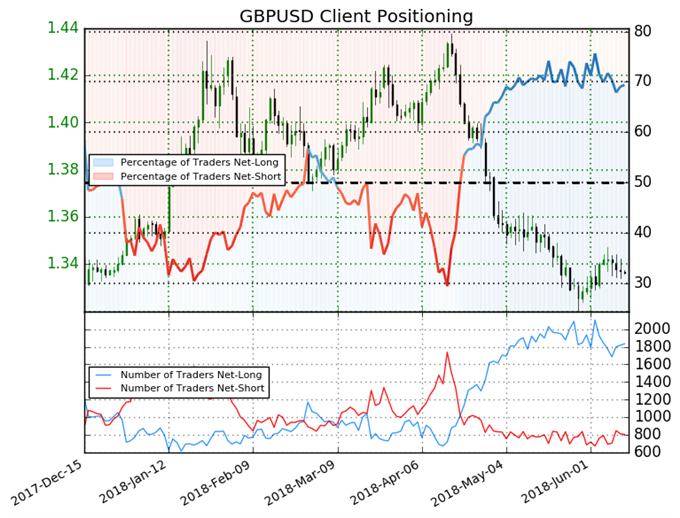

IG Client Sentiment Index: GBPUSD Chart of the Day

GBPUSD: Data shows 69.4% of traders are net-long with the ratio of traders long to short at 2.27 to 1. In fact, traders have remained net-long since Apr 20 when GBPUSD traded near 1.42353; price has moved 6.1% lower since then. The number of traders net-long is 2.6% higher than yesterday and 4.6% lower from last week, while the number of traders net-short is 4.9% lower than yesterday and 5.8% higher from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests GBPUSD prices may continue to fall. Positioning is more net-long than yesterday but less net-long from last week. The combination of current sentiment and recent changes gives us a further mixed GBPUSD trading bias

Five Things Traders are Reading

- “Preview for June FOMC Meeting and Outlook for US Dollar” by Christopher Vecchio, CFA, Sr. Currency Strategist

- “Charts Ahead of FOMC & ECB – USD, EUR/USD, AUD/USD, Gold Price & More” by Paul Robinson, Market Analyst

- “USDCAD Bulls Look to Revisit 2018 Highs on Hawkish Fed” by Justin McQueen, Market Analyst

- “GBPUSD May Fall Further After In-Line UK Inflation Data”by Martin Essex, MSTA , Analyst and Editor

- “USD Boosted by Fed’s Powell Ahead of the FOMC Meeting” by Nick Cawley, Market Analyst

— Written by Justin McQueen, Market Analyst

To contact Justin, email him at Justin.mcqueen@ig.com

Follow Justin on Twitter @JMcQueenFX