- December 21, 2020 Do we get tax benefits on Personal Loan?

- December 18, 2020 The solicitors Preston depends on for stress-free compensation claims

- December 16, 2020 eToro: History and Key Features

- December 11, 2020 Canadian Dollar Pauses 2020 Rally Against US Peer Amid Falling Crude Prices

- December 11, 2020 Pound Crashes Against Dollar As No-Deal Brexit Appears Imminent

- December 11, 2020 USD/JPY 104.57 High Starting a New Bearish Leg?

Day: June 14, 2018

June 14

June 142018

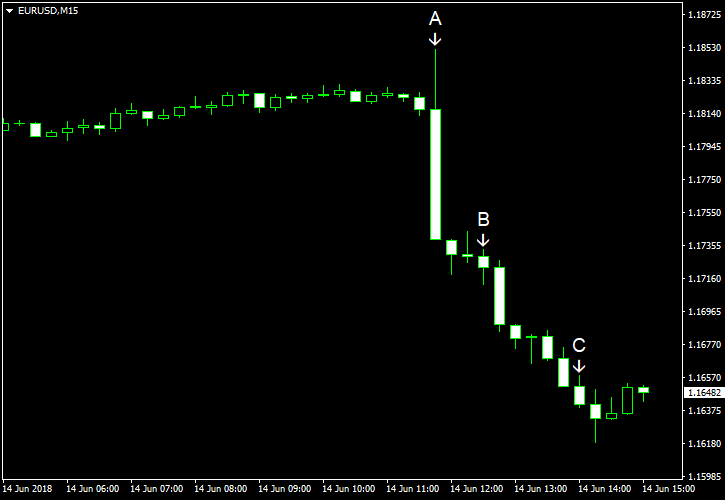

EUR/USD Crashes as ECB Promises No Rate Hikes in 2018

EUR/USD was gradually rising today but crashed after the European Central Bank signaled that it is not going to raise interest rates this year. (Event A on the chart.) US macroeconomic indicators released in the United States afterwards were good across the board, giving no reprieve for the currency pair. Retail sales rose 0.8% in May from the previous month, two times the forecast increase of 0.4%. The April increase […]

Read more June 14

June 142018

Pound Mixed amid Clashing Fundamentals

The Great Britain pound was ending the Thursday’s trading session mixed. The sterling rose against some rivals, propelled higher by very good retail sales data, but fell versus others, dragged down by the market’s risk-negative sentiment that followed the dovish policy statement from the European Central Bank. The Office for National Statistics reported that Britain’s retail sales rose 1.3% in May from April. That is compared […]

Read more June 14

June 142018

Australian Dollar Lower on Risk Aversion, Economic Data

The Australian dollar was extremely soft against other most-traded currencies, with the notable exception of the euro, as the unexpectedly dovish policy statement of the European Central Bank as well as the threat of the US-China trade war put the market into the risk-off mode. Macroeconomic data in Australia and Australia’s biggest trading partner, China, hurt the Aussie as well. The Australian Bureau of Statistics reported that employment rose by 12,000 in May from April, trailing the average forecast […]

Read more June 14

June 142018

US Dollar Surges After FOMC & ECB Meetings

The US dollar gained sharply on other currencies today after the European Central Bank made a surprisingly dovish policy statement. Yesterday, the currency had a mixed reaction to the hawkish statement from the Federal Reserve, rallying initially but falling afterwards. Yet Fed hawkishness is a bullish factor in the long and may be responsible to some degree for the currency’s rally today. Yesterday, the Federal Open Market Committee left interest rates unchanged, […]

Read more June 14

June 142018

Euro Sinks As ECB Says No Interest Rate Hikes in 2018

The euro dipped today following the European Central Bank policy meeting as the ECB signaled that it is not going to raise interest rates in 2018 — a message that markets did not like. The central bank made a policy decision today, keeping its monetary policy unchanged, as was widely expected. The ECB stated that it expects that the quantitative easing program will stay in place till the end of the year: […]

Read more June 14

June 142018

GBPUSD Rises as Royal Wedding Celebrations Lifts Retail Sales

GBP Analysis and Talking Points UK retail sales posts another sizeable rebound amid royal wedding celebrations GBPUSD regains firm footing above 1.34 See our Q2 GBP forecast to learn what will drive the currency through the quarter. Royal Wedding Fever Lifts Consumer Spending Another sizeable rebound in UK retail sales for May, which saw all […]

Read more June 14

June 142018

Technical Outlook – EURGBP Battling Confluence of Resistance

EURGBP Latest News and Analysis Ascending triangle may produce a bullish upside break. Technical indicators likely to keep any advance in check. ECB may turn hawkish but recent weak data may hold intentions in check. EURGBP Moves Trapped by Technical Backdrop EURGBP has traded in a narrow range over the last month, held in check […]

Read more June 14

June 142018

EURUSD May Fall as ECB Disappoints the Euro Bulls

EURUSD news and analysis: – The European Central Bank’s Governing Council will discuss ending its stimulus program today but an announcement of the end of QE is unlikely until July. – That could weaken EURUSD unless ECB President Mario Draghi adopts a hawkish stance at his press conference after the meeting. Check out the IG […]

Read more June 14

June 142018

ECB Announces QE Taper, However, EUR Falls on Rate Path Guidance

EURUSD Analysis and Talking Points ECB to reduce QE purchases by EUR 15bln and exit by December ECB does not see rate rise until at least summer 2019 See our Q2 EUR forecast to learn what will drive the currency through the quarter. ECB Surprises with QE Taper Announcement and Rate Path Guidance ECB surprised […]

Read more June 14

June 142018

EURUSD May Fall Sharply in the Months Ahead

EURUSD News and Talking Points – By the end of 2019, the Fed may well have hiked another five or six times and the ECB likely just once – Fibonacci retracement back to EURUSD 1.1200 is on the cards in the longer-term. The DailyFX Q2 Trading Forecasts for all major currencies, commodities and indices, are […]

Read more