Fundamental Forecast for Crude Oil Price: Bearish

Crude Oil Analysis and Talking Points:

- Saudi Arabia and Russian Set to Turn the Supply Taps on

- OPEC likely to relax production quota’s question is, by how much?

OPEC Preview: A Crude Awakening

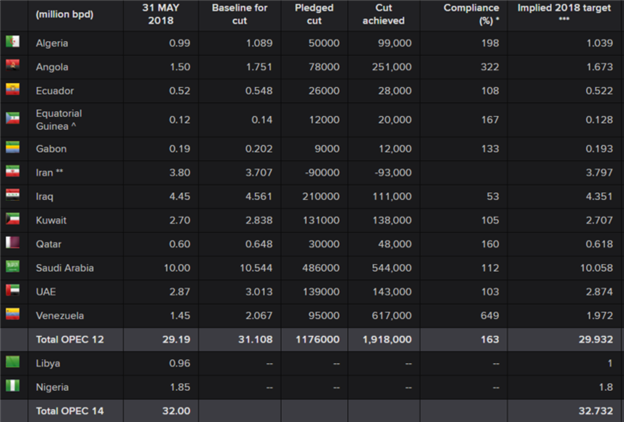

OPEC’s 174th ordinary meeting is set to take place on June 22nd with the JMMC scheduled to meet the day before, while OPEC/non-OPEC ministers are due to meet on the 23rd. As we head to the meeting, expectations are for a relaxing of the current oil supply quota’s, which has been increasingly suggested by oil kingpins Saudi Arabia and Russia that the supply switch has been turned on. Both Saudi Arabia and Russia look to maintain market stability amid possible supply shocks from rapidly declining production from Venezuela and potential production losses from Iran (following US withdrawal from nuclear deal), while demand growth remains robust as evidenced by reports from the EIA, IEA and OPEC. Additionally, compliance among OPEC members is over 160%, largely due to declining Venezuelan production.

Source: Thomson Reuters (OPEC Production & Compliance)

President Trump Pressuring OPEC

Another reason for the consideration to raise production has been due to the mounting pressure from President Trump, who has been critical of OPEC, stating that they are artificially keeping oil prices high. Trump’s request comes in the context with domestic gas prices at near 4-year highs ahead of the summer driving season.

Unity Seemingly Gulfs Apart

Various oil ministers, most notably from Iran, Iraq and Venezuela, have been somewhat critical over raising production amid the request to do so from President Trump. However, despite this, Saudi Energy Minister remains optimistic that an agreement on a gradual increase of output will be inevitable.

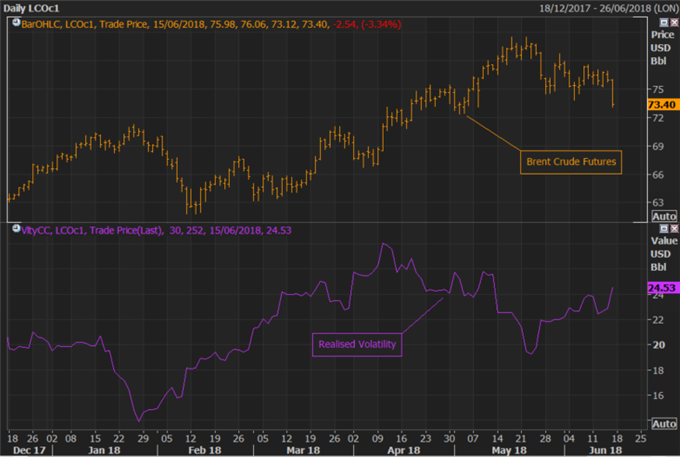

The question is, by how much will oil production be boosted? Non-OPEC member Russia have proposed that oil output is increased by 1.8mln bpd (essentially exiting current supply pact), while Saudi Arabia and most likely the majority of the camp will prefer to boost production around 500k-700k bpd to offset Venezuela’s falling output. Given the price action seen in oil prices, and the increased realised volatility, Saudi Arabia’s proposal has largely been priced. Subsequently, this could hint at a sell the rumour, buy the fact type price action. However, a decision closer to Russia’s proposal i.e. >1mln bpd, will likely see oil prices come under renewed pressure.

Trade Wars Denting Oil Prices

Aside from the OPEC meeting, another cause of concern for commodity markets have been the escalation in trade wars. President Trump approved $50bln worth of import tariffs on China. However, a retaliation from China will likely dent investors’ appetite for risk, consequently weighing on oil prices.

BRENT CRUDEPRICE CHART: DAILY TIMEFRAME (October 2017-June 2018)

On the downside, $73 holds for now, a close below $73.30 could see downward pressure continue with 100DMA seen as the next support zone at $71.74. Strong support stemming from the rising trendline from June 2017, which sits at $71. On the upside, resistance lies at $73.90-$74. A break through, could see a retest for $75.

OIL TRADING RESOURCES:

- See our quarterly oil forecast to learn what will drive prices through mid-year!

- Just getting started? See our beginners’ guide for FX traders

- Having trouble with your strategy? Here’s the #1 mistake that traders make

— Written by Justin McQueen, Market Analyst

To contact Justin, email him at Justin.mcqueen@ig.com

Follow Justin on Twitter @JMcQueenFX