Current Developments – Central Bank Conference, May Wins Brexit Vote

A lack of key economic updates had FX traders eyeing the central bank conference in Sintra, Portugal. There, governors and presidents shared similar concerns on the impact of trade wars on investment. Fed Chair Jerome Powell repeated the case for gradual rate increases. However, he also said that trade policy changes could cause them to change their outlook.

As such, the US Dollar didn’t offer a meaningful response to the Fed commentary. It appeared to be more interested in risk trends. On this front, it was inversely tracking the S&P 500 which gapped higher and swung throughout the day. The greenback finished ever so cautiously higher. The Euro was little changed across the board.

Meanwhile in the UK, Prime Minister Theresa May narrowly won a vote by 319-303 which as a result means Parliament won’t have as much power over Brexit talks. If she had lost, Parliament could have vetoed the terms of the divorce settlement, preventing a Brexit without a deal. Still, the British Pound was ever so slightly higher against its major peers. Traders may have not taken large bets ahead of the BOE rate decision.

A Look Ahead – Markets Eye NZ GDP Data

Top economic event risk during the Asian session will be the first quarter New Zealand GDP data. There, growth is anticipated to slow down to 2.7% y/y in the first quarter from 2.9% prior. Recently, local economic data has been tending to underperform relative to economists expectations, opening the door to a downside surprise here. Such an outcome can lower RBNZ hawkish expectations and send the New Zealand Dollar lower.

Join our New Zealand GDP release live webinar for coverage of the NZD/USD response as well as what to expect going forward!

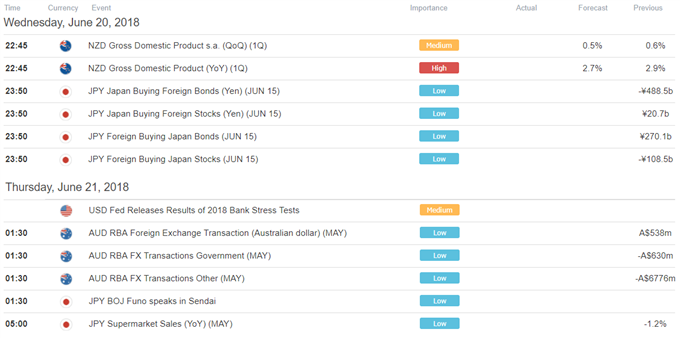

DailyFX Economic Calendar: Asia Pacific (all times in GMT)

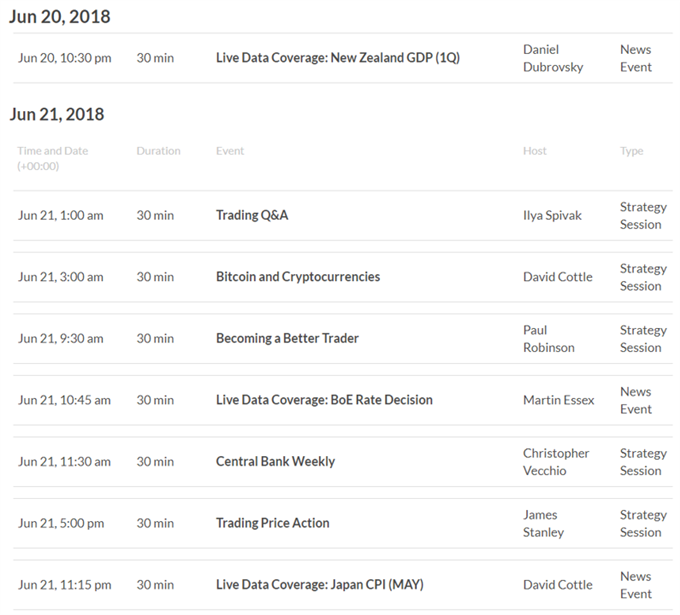

DailyFX Webinar Calendar – CLICK HERE to register (all times in GMT)

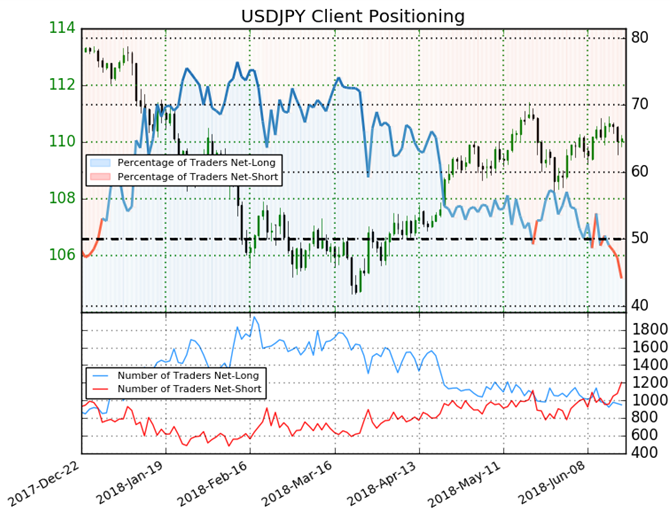

IG Client Sentiment Index Chart of the Day: USD/JPY

CLICK HERE to learn more about the IG Client Sentiment Index

Retail trader data shows 44.1% of USD/JPY traders are net-long with the ratio of traders short to long at 1.27 to 1. The number of traders net-long is 2.5% higher than yesterday and 15.6% lower from last week, while the number of traders net-short is 20.3% higher than yesterday and 12.1% higher from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests USD/JPY prices may continue to rise. Traders are further net-short than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger USD/JPY-bullish contrarian trading bias.

Five Things Traders are Reading:

- Weak New Zealand 1Q GDP Report to Fuel NZD/USD Losses by David Song, Currency Analyst

- Fed, ECB, BoJ, RBA Leaders Weigh in on Trade Policy Risk at Sintra Conference by Peter Hanks, DailyFX Team

- XAU/USD Technical Outlook: Gold Prices Search for Supportby Michael Boutros, Currency Strategist

- Wait-and-See Bank of England (BoE) to Sap GBP/USD Rebound by David Song, Currency Analyst

- US-China Trade War: An Inevitable Conflict and The Impact on Equities, FXby Renee Mu, Currency Analyst

— Written by Daniel Dubrovsky, Junior Currency Analyst for DailyFX.com

To contact Daniel, use the comments section below or @ddubrovskyFX on Twitter