CHF Analysis and Talking Points

- Swiss Franc Unchanged as the SNB Stands Pat on Monetary Policy

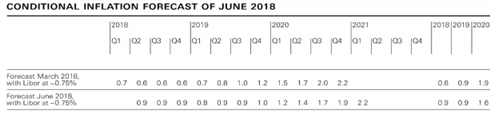

- Long Term Inflation Forecasts Downgraded

Swiss National Bank Assessment Unchanged from Prior

The Swiss Franc was little changed following the quarterly SNB monetary policy decision. Unsurprisingly, the central bank kept its 3-month target Libor rate unchanged at -0.75% as expected. Additionally, the SNB reiterated that the Swiss Franc remains “highly valued”, while also noting that they are prepared to intervene in FX markets if needed.

Negative Rates for Longer

The SNB left its growth forecast for 2018 unchanged at 2%, however, they highlighted that risks to the baseline scenario are more to the downside amid the increased uncertainty surrounding political developments, alongside growing unease over international tensions and protectionist policies leading to trade wars.

In terms of inflation forecasts, the central bank had upgraded their short term inflation forecast with 2018 inflation seen at 0.9% from 0.6% in the March assessment following the rise in oil prices. Although, the SNB pushed back the time it will take for them to hit their 2% inflation target, which is not expected to be hit until Q1 2021 vs. Previous Q3 2020. As such, this signals that the SNB will keep negative rates for longer.

Source: SNB

EURCHF PRICE CHART: 1-HOUR TIME FRAME (June 12- June 21)

The EURCHF has largely been dictated by the ongoing political uncertainty in Europe and increased trade war tensions between the US and China. Escalating tensions between US and China could see EURCHF test last week lows at 1.15, which continues to act as strong support, while a break through there would put 1.1465 in focus.

IG Client Positioning Sentiment notes that the fact that traders are net-long prices may continue to fall. For full client positioning click here

— Written by Justin McQueen, Market Analyst

To contact Justin, email him at Justin.mcqueen@ig.com

Follow Justin on Twitter @JMcQueenFX