US Market Snapshot via IG: DJIA -0.4%, Nasdaq 100 0.1%, S&P 500 -0.2%

Major Headlines

- Bank of England Keep Bank Rate at 0.5%, Vote split 6-3 (Prev. 7-2)

- Italy appoint two Eurosceptics to head finance committee

- Saudi Arabia sees a 1mln bpd oil increase as a reasonable target.

GBP:Sterling bulls have been provided with some hope following the Bank of England rate decision, after Chief Economist Haldane joined McCafferty and Saunders in voting for a hike. As such, the surprise 6-3 vote split took GBP to fresh intra-day highs with August rate hike bets rising to 45% from 33%.

EUR: Italian political uncertainty returning after Italy appoints two Eurosceptics to head the finance committee, consequently, the Euro is off best levels of the day, falling the underperformance in Italian assets. Although, it is not clear how much influence their roles will have on dictating economic policy, one thing is clear and it’s their critical view on the Euro.

Crude Oil: Brent and WTI crude futures are trading in the red as OPEC near deal to increase output. Reports have suggested that the Saudi Energy Minister views a 1mln bpd oil increase as a good target to work with, while OPEC sources have also indicated that Iran may be open to an agreement. Subsequently, this is likely to keep oil prices on the back foot.

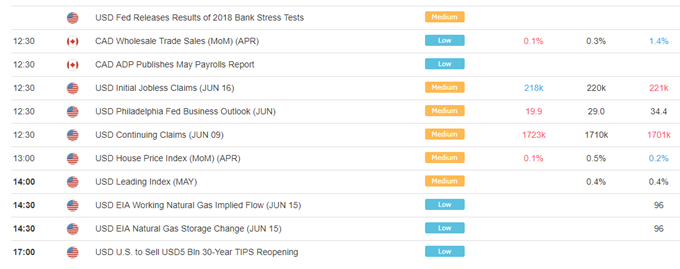

DailyFX Economic Calendar: Thursday, June 21, 2018 – North American Releases

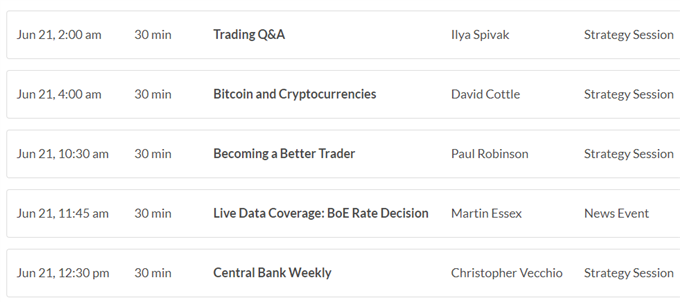

DailyWebinar Calendar: Thursday, June 21, 2018

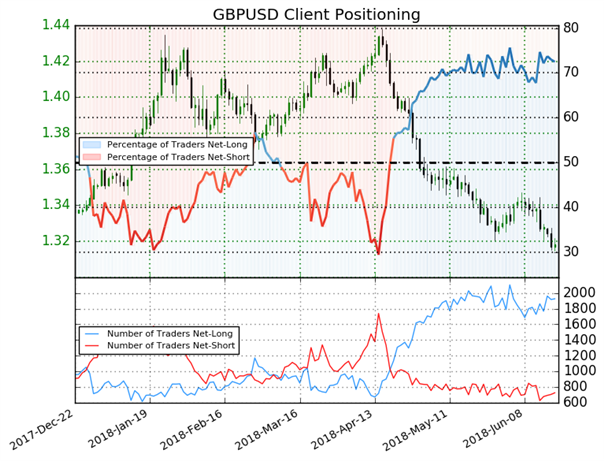

IG Client Sentiment Index: GBPUSD Chart of the Day

GBPUSD: Data shows 72.5% of traders are net-long with the ratio of traders long to short at 2.63 to 1. In fact, traders have remained net-long since Apr 20 when GBPUSD traded near 1.41803; price has moved 7.1% lower since then. The number of traders net-long is 2.0% higher than yesterday and 8.5% higher from last week, while the number of traders net-short is 2.4% higher than yesterday and 20.6% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests GBPUSD prices may continue to fall. Positioning is less net-long than yesterday but more net-long from last week. The combination of current sentiment and recent changes gives us a further mixed GBPUSD trading bias.

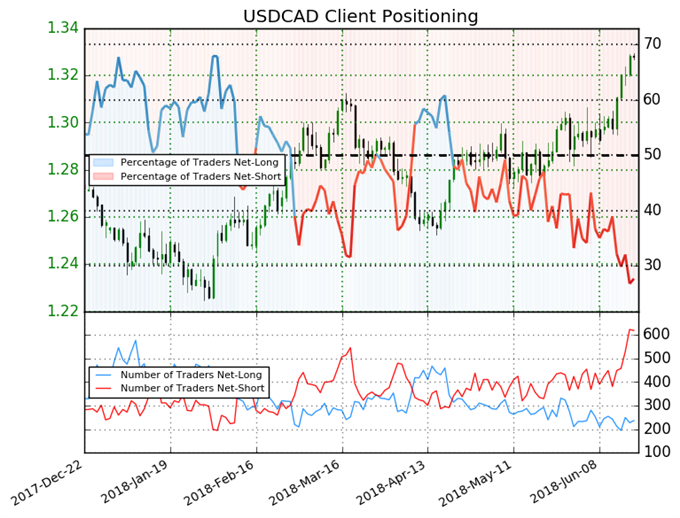

USDCAD: Data shows 27.7% of traders are net-long with the ratio of traders short to long at 2.61 to 1. In fact, traders have remained net-short since May 22 when USDCAD traded near 1.28776; price has moved 3.1% higher since then. The number of traders net-long is 2.6% higher than yesterday and 6.7% lower from last week, while the number of traders net-short is 1.6% lower than yesterday and 39.1% higher from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests USDCAD prices may continue to rise. Positioning is less net-short than yesterday but more net-short from last week. The combination of current sentiment and recent changes gives us a further mixed USDCAD trading bias

Five Things Traders are Reading

- “Central Bank Weekly: British Pound Carves Out Reversal Candles after BOE” byChristopher Vecchio, CFA, Sr. Currency Strategist

- “Sterling Bulls Offered Hope as Bank of England Raises August Rate Hike Bets” by Justin McQueen, Market Analyst

- “Gold & Silver Price Forecast – Extended but at Risk of More Losses”by Paul Robinson, Market Analyst

- “EURUSD and Italian Assets Fall as Italian Political Uncertainty Returns”by Justin McQueen, Market Analyst

- “Oil Price Analysis: Downtrend Intact Ahead of OPEC” by Nick Cawley, Market Analyst

— Written by Justin McQueen, Market Analyst

To contact Justin, email him at Justin.mcqueen@ig.comFollow Justin on Twitter @JMcQueenFX