EUR/USD

Floor pivot points

| 3rd Sup |

2nd Sup |

1st Sup |

Pivot |

1st Res |

2nd Res |

3rd Res |

|

| 1.1382 |

1.1445 |

1.1550 |

1.1612 |

1.1717 |

1.1779 |

1.1884 |

Woodie’s pivot points

| 2nd Sup |

1st Sup |

Pivot |

1st Res |

2nd Res |

| 1.1456 |

1.1570 |

1.1623 |

1.1737 |

1.1790 |

Camarilla pivot points

| 4th Sup |

3rd Sup |

2nd Sup |

1st Sup |

1st Res |

2nd Res |

3rd Res |

4th Res |

| 1.1562 |

1.1608 |

1.1623 |

1.1639 |

1.1669 |

1.1685 |

1.1700 |

1.1746 |

Tom Demark’s pivot points

| Support |

Resistance |

| 1.1581 |

1.1748 |

Fibonacci retracement levels

| 0.0% |

23.6% |

38.2% |

50.0% |

61.8% |

100.0% |

| 1.1508 |

1.1547 |

1.1572 |

1.1591 |

1.1611 |

1.1675 |

GBP/USD

Floor pivot points

| 3rd Sup |

2nd Sup |

1st Sup |

Pivot |

1st Res |

2nd Res |

3rd Res |

|

| 1.2927 |

1.3014 |

1.3140 |

1.3227 |

1.3353 |

1.3440 |

1.3566 |

Woodie’s pivot points

| 2nd Sup |

1st Sup |

Pivot |

1st Res |

2nd Res |

| 1.3024 |

1.3159 |

1.3237 |

1.3372 |

1.3450 |

Camarilla pivot points

| 4th Sup |

3rd Sup |

2nd Sup |

1st Sup |

1st Res |

2nd Res |

3rd Res |

4th Res |

| 1.3148 |

1.3207 |

1.3226 |

1.3246 |

1.3285 |

1.3304 |

1.3324 |

1.3382 |

Tom Demark’s pivot points

| Support |

Resistance |

| 1.3183 |

1.3396 |

Fibonacci retracement levels

| 0.0% |

23.6% |

38.2% |

50.0% |

61.8% |

100.0% |

| 1.3102 |

1.3152 |

1.3183 |

1.3208 |

1.3233 |

1.3315 |

USD/JPY

Floor pivot points

| 3rd Sup |

2nd Sup |

1st Sup |

Pivot |

1st Res |

2nd Res |

3rd Res |

|

| 108.22 |

108.89 |

109.43 |

110.09 |

110.64 |

111.30 |

111.84 |

Woodie’s pivot points

| 2nd Sup |

1st Sup |

Pivot |

1st Res |

2nd Res |

| 108.86 |

109.37 |

110.06 |

110.58 |

111.27 |

Camarilla pivot points

| 4th Sup |

3rd Sup |

2nd Sup |

1st Sup |

1st Res |

2nd Res |

3rd Res |

4th Res |

| 109.31 |

109.64 |

109.75 |

109.86 |

110.08 |

110.20 |

110.31 |

110.64 |

Tom Demark’s pivot points

| Support |

Resistance |

| 109.16 |

110.37 |

Fibonacci retracement levels

| 0.0% |

23.6% |

38.2% |

50.0% |

61.8% |

100.0% |

| 109.55 |

109.83 |

110.01 |

110.15 |

110.29 |

110.76 |

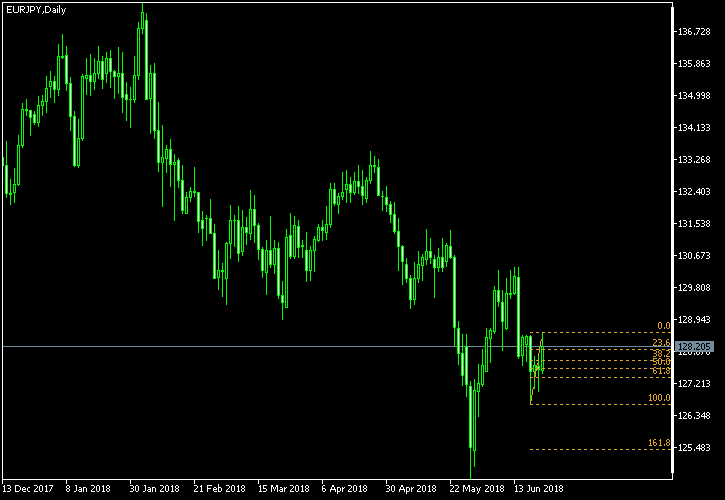

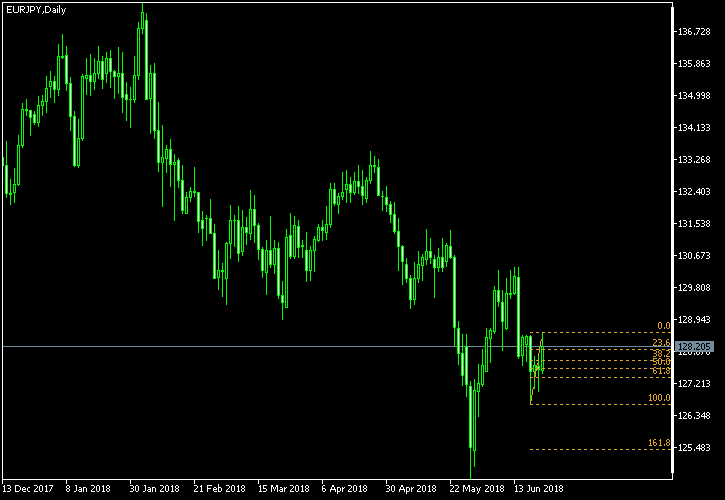

EUR/JPY

Floor pivot points

| 3rd Sup |

2nd Sup |

1st Sup |

Pivot |

1st Res |

2nd Res |

3rd Res |

|

| 125.07 |

125.86 |

127.03 |

127.81 |

128.99 |

129.77 |

130.95 |

Woodie’s pivot points

| 2nd Sup |

1st Sup |

Pivot |

1st Res |

2nd Res |

| 125.95 |

127.23 |

127.91 |

129.18 |

129.87 |

Camarilla pivot points

| 4th Sup |

3rd Sup |

2nd Sup |

1st Sup |

1st Res |

2nd Res |

3rd Res |

4th Res |

| 127.13 |

127.67 |

127.85 |

128.03 |

128.38 |

128.56 |

128.74 |

129.28 |

Tom Demark’s pivot points

| Support |

Resistance |

| 126.44 |

128.40 |

Fibonacci retracement levels

| 0.0% |

23.6% |

38.2% |

50.0% |

61.8% |

100.0% |

| 126.64 |

127.10 |

127.39 |

127.62 |

127.85 |

128.60 |

GBP/JPY

Floor pivot points

| 3rd Sup |

2nd Sup |

1st Sup |

Pivot |

1st Res |

2nd Res |

3rd Res |

|

| 141.90 |

143.14 |

144.51 |

145.75 |

147.12 |

148.37 |

149.74 |

Woodie’s pivot points

| 2nd Sup |

1st Sup |

Pivot |

1st Res |

2nd Res |

| 143.17 |

144.58 |

145.79 |

147.19 |

148.40 |

Camarilla pivot points

| 4th Sup |

3rd Sup |

2nd Sup |

1st Sup |

1st Res |

2nd Res |

3rd Res |

4th Res |

| 144.44 |

145.16 |

145.40 |

145.64 |

146.12 |

146.36 |

146.60 |

147.32 |

Tom Demark’s pivot points

| Support |

Resistance |

| 143.83 |

146.44 |

Fibonacci retracement levels

| 0.0% |

23.6% |

38.2% |

50.0% |

61.8% |

100.0% |

| 144.38 |

145.00 |

145.38 |

145.69 |

146.00 |

147.00 |

If you have any questions or comments on this technical analysis, please feel free to reply below.