US Market Snapshot via IG: DJIA -0.6%, Nasdaq 100 -0.7%, S&P 500 -0.4%

Major Headlines

- President Trump announces plan to restrict Chinese Investments

- CFTC Data shows USD position switch to net long

- German business confidence falls on trade war concerns -IFO

JPY:Global trade tensions continue to linger with the US drawing up plans to limit Chinese investment in US technology firms, while the EU has promised to respond to any auto tariffs. Subsequently, trade worries have heightened risk aversion and led to a bid in the relative safety of the Japanese Yen. USDJPY back towards the mid-109s, however remains well within the recent range.

EUR: The Euro is better supported despite this morning despite a relatively mixed IFO report, which showed German business confidence deteriorating amid rising uncertainty surrounding trade wars and slowing global growth. Additionally, the latest CFTC data showed huge speculative selling in the wake of the ECB’s announcement to delay the timing of the first-rate hike, which in turn suggests that EURUSD may have based out around 1.1510.

AUD: Modest losses for AUD as President Trump ups the trade war ante against China. Over the weekend, President Trump announced that the US is planning new measures on tech exports to China and on Chinese investment, given the Australian Dollars large exposure to China, the currency has been among the underperformers today.

DailyFX Economic Calendar: Monday, June 25, 2018 – North American Releases

DailyWebinar Calendar: Monday, June 25, 2018

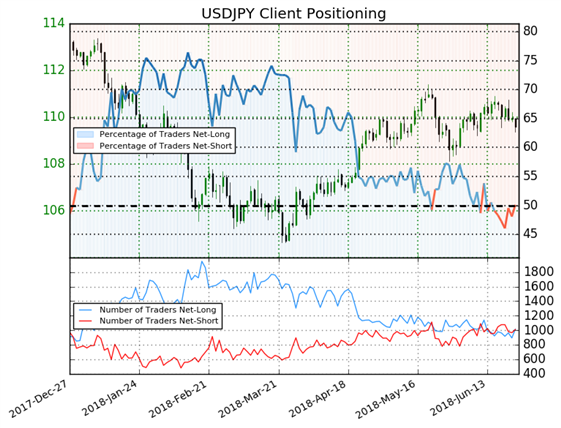

IG Client Sentiment Index: USDJPY Chart of the Day

USDJPY: Data shows 50.1% of traders are net-long with the ratio of traders long to short at 1.0 to 1. The number of traders net-long is 7.7% higher than yesterday and 5.3% higher from last week, while the number of traders net-short is 0.3% higher than yesterday and 5.9% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests USDJPY prices may continue to fall. Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger USDJPY-bearish contrarian trading bias.

Five Things Traders are Reading

- “Euro Forecast: Euro Turn to June CPI for Next Catalyst” byChristopher Vecchio, CFA, Sr. Currency Strategist

- “UK Week Ahead: Brexit and Risk in Control of GBP and FTSE | Webinar” by Nick Cawley, Market Analyst

- “DAX 30 – US Trade Fears and Auto Blues”by Nick Cawley, Market Analyst

- “Australian Dollar Outlook Bearish on Rising Trade War Tensions”by Justin McQueen, Market Analyst

- “USDJPY Hit by Trade War Rhetoric; Technical Indicators Collide” by Nick Cawley, Market Analyst

— Written by Justin McQueen, Market Analyst

To contact Justin, email him at Justin.mcqueen@ig.com

Follow Justin on Twitter @JMcQueenFX