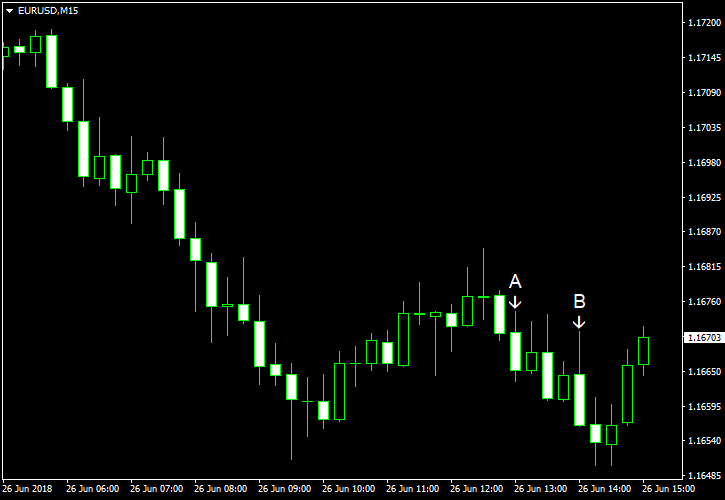

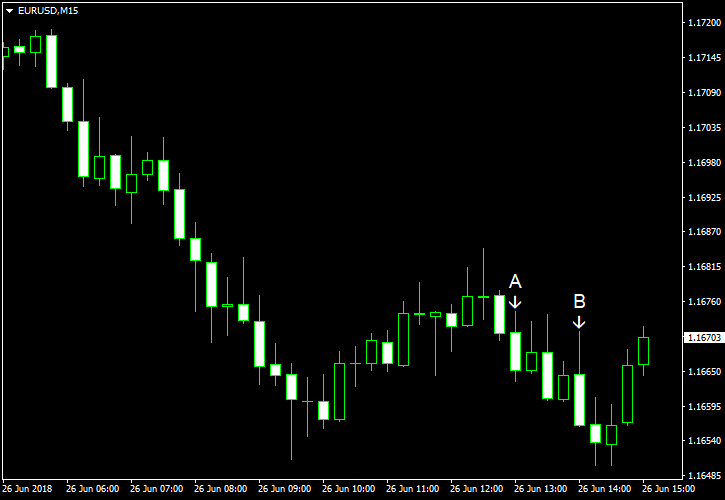

EUR/USD declined today as the threat of trade wars continued to weigh on markets. Today’s US data did not provide a direction to the currency pair because it was mixed. The housing and consumer confidence reports were underwhelming, while the manufacturing data was surprisingly good.

S&P/Case-Shiller home price index rose 6.6% in April, year-on-year, missing the average estimate of 6.9% and slowing from the previous month’s 6.7% rate of growth. Month-on-month, the index rose 0.8%. (Event A on the chart.)

Richmond Fed manufacturing index rose from 16 in May to 20 in June. Analysts had expected the index to be little changed at 15. (Event B on the chart.)

Consumer confidence dropped to 126.4 in June from 128.8 in May, far below the forecast level of 127.6. (Event B on the chart.)

If you have any comments on the recent EUR/USD action, please reply using the form below.