EURUSD Analysis and Talking Points

- Italian Consumer and Business Confidence Stabilises Amid Reduced Political Uncertainty

- French Consumer Confidence Falls to Lowest in 2yrs

Italian Consumer and Business Confidence Stabilises

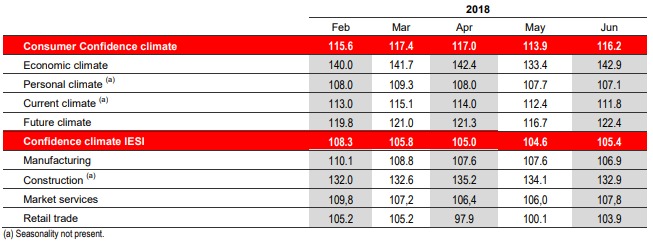

The Euro and FTSE MIB were largely unmoved following the release of the latest Italian consumer and business confidence surveys. With regard to the consumer survey, the confidence climate in June rose from 113.9 to 116.2. This followed the improvement in economic and future components, which offset the decline in the personal and current components. In terms of business confidence, this dipped to 106.9 from 107.6, however, the overall business composite reading had stabilised. It is likely that the recovery in both consumer and business confidence had stemmed from the reduced uncertainty in regard to Italian politics, given that the league and 5-star party had agreed to form a coalition.

Source: Istat

French Consumer Confidence at Lowest Level in 2yrs

In contrast, French consumer confidence missed expectations to fall to its lowest level since August 2016 at 97, below the expected 100. As a reminder, earlier this month INSEE forecast slower French economic growth for the rest of 2018 amid a earlier strength in the Euro, coupled with higher oil prices and uncertainty over US protectionist measures.

EURUSD PRICE CHART: DAILY TIME FRAME (December 2016- June 2018)

EURUSD continues to meet resistance at the 38.2% retracement of the 1.0340-1.2256 rise (1.1709). As such, failure to break above has seen the pair grind lower, with 1.16 the initial target for EURUSD sellers. Near term base for EURUSD is situated at 1.1510, which marks the double bottom from the May and June lows.

IG Client Positioning Sentiment states that the fact that traders are net-long suggests prices may continue to fall. For full client positioning click here

Additional EUR Analysis

– EURUSD Price Forecast – Euro Sellers Taking Back Control

— Written by Justin McQueen, Market Analyst

To contact Justin, email him at Justin.mcqueen@ig.com

Follow Justin on Twitter @JMcQueenFX