CAD Analysis and Talking Points

- Canadian GDP to determine BoC July rate move

- Trade War tensions raises risk of BoC hold

Data Dependent Bank of Canada

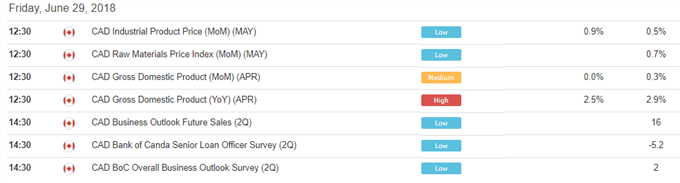

The outlook for the Canadian Dollar and the BoC’s rate path in the near term (July meeting) will likely be dictated by the upcoming GDP figures and BoC survey, scheduled at 12:30GMT and 14:30GMT respectively. The annual GDP rate is expected to dip to 2.5% from 2.9%, which would represent a fall to 0% from 0.3% for the monthly figure. Recent data from Canada has been a touch softer, which in turn raises the downside risks to today’s GDP report. As such, if GDP misses expectations then this could provide a further warning that the underlying economy is weak and thus push back rate hike expectations.

Trade Wars Raises Risk of Hold

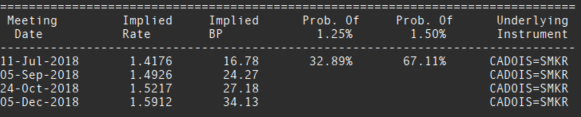

Although the Bank of Canada emphasises that they are data dependent, Governor Poloz stated that the central bank would incorporate the recent escalation in trade war tensions and actions into their forecasts at the July meeting. As such, while this keeps a July rate hike on the table where OIS markets are pricing in a 67% chance of a hike, it does however increase the risks of a potential hold, which could see CAD remain on a bearish trend.

Source: Thomson Reuters

IG Client Positioning Sentimentthe combination of current sentiment and recent changes gives us a stronger USDCAD-bullish contrarian trading bias. For full client positioning click here

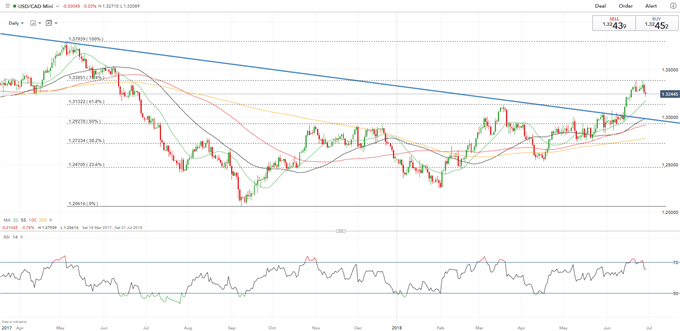

USDCAD PRICE CHART: Daily Time Frame (March 2017-July 2018)

USDCAD has failed twice to breach above 1.3385 (76.4% Fibonacci retracement of the 1.3793-1.2061 fall), a softer GDP figure could see this breached. However, with momentum on the downside as RSI indicators shift lower, a better than expected reading may see USDCAD make a test for 1.31.

— Written by Justin McQueen, Market Analyst

To contact Justin, email him at Justin.mcqueen@ig.com

Follow Justin on Twitter @JMcQueenFX