- December 21, 2020 Do we get tax benefits on Personal Loan?

- December 18, 2020 The solicitors Preston depends on for stress-free compensation claims

- December 16, 2020 eToro: History and Key Features

- December 11, 2020 Canadian Dollar Pauses 2020 Rally Against US Peer Amid Falling Crude Prices

- December 11, 2020 Pound Crashes Against Dollar As No-Deal Brexit Appears Imminent

- December 11, 2020 USD/JPY 104.57 High Starting a New Bearish Leg?

Day: July 6, 2018

July 6

July 62018

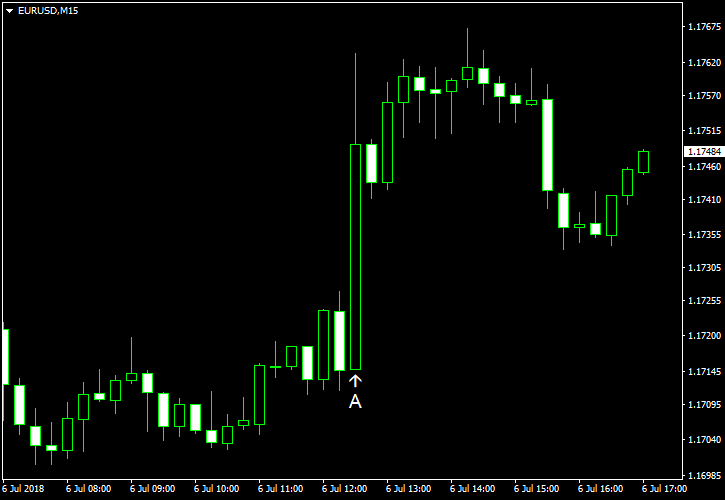

EUR/USD Rallies on Soft NFP

EUR/USD rallied today, finding help from the disappointing US nonfarm payrolls. While employment rose more than was expected, other indicators failed to meet expectations. The currency pair rallied even as new US tariffs of Chinese goods kicked in, meaning that the trade war between the United States and China has officially started. Nonfarm payrolls surprised positively in terms of employment growth, showing an increase by 213k in June, […]

Read more July 6

July 62018

Canadian Unemployment Disappoints Ahead of Next Week’s BoC Rate Decision

Talking Points: Canadian unemployment for June rests at 6.0%, increasing 0.2 percentage points from May The Canadian dollar climbed versus the dollar as unemployment similarly ticked higher in the US Trade remains a pivotal topic for the Canadian economy as NAFTA remains unresolved and metal tariffs in place Bank of Canada’s rate decision is scheduled […]

Read more July 6

July 62018

USD/CAD Trades Lower on Disappointing Duo of Employment Reports

The USD/CAD currency pair today headed lower as the Canadian dollar gained against its US counterpart following disappointing jobs reports from both countries. The pair’s decline was further accelerated by the selling pressure on the US dollar following the high US unemployment rate reported. The USD/CAD currency pair today declined from an opening high of 1.3150 to a low of 1.3083 in the American session. The currency pair was in a consolidative phase for most of today’s […]

Read more July 6

July 62018

USD/CAD Trades Lower on Disappointing Duo of Employment Reports

The USD/CAD currency pair today headed lower as the Canadian dollar gained against its US counterpart following disappointing jobs reports from both countries. The pair’s decline was further accelerated by the selling pressure on the US dollar following the high US unemployment rate reported. The USD/CAD currency pair today declined from an opening high of 1.3150 to a low of 1.3083 in the American session. The currency pair was in a consolidative phase for most of today’s […]

Read more July 6

July 62018

EUR/USD Rallies on Soft NFP

EUR/USD rallied today, finding help from the disappointing US nonfarm payrolls. While employment rose more than was expected, other indicators failed to meet expectations. The currency pair rallied even as new US tariffs of Chinese goods kicked in, meaning that the trade war between the United States and China has officially started. Nonfarm payrolls surprised positively in terms of employment growth, showing an increase by 213k in June, […]

Read more July 6

July 62018

CAD to Gain on Firm Canadian Jobs Report Giving Green Light to BoC Hike

CAD Analysis and Talking Points Canada expected to add 24k jobs for the month of June Better than expected jobs report to cement BoC rate hike next week. Canada is expected to show a jobs gain of 24k (Low 20k, High 35k) with the unemployment rate standing at 5.8%. A reading above expectations should cement […]

Read more July 6

July 62018

US Dollar Falls on Overall Soft NFP Report as Wage Data Misses Forecasts

NFP Analysis and Talking Points US Nonfarm Payrolls rose by 213k in June, beating expectations of 195k expected; Prior month revised higher. US Average Hourly Earnings misses forecasts. US Unemployment Rate shows surprise 0.2ppt rise amid boost in participation rate See our latest Q3 FX forecast to learn what will drive the currency through the […]

Read more July 6

July 62018

Japanese Yen Falls After Mixed Data, Risk Aversion Provides No Help

The Japanese yen was flat against the US dollar and fell versus other major currencies today despite the gloomy mood among investors as the trade war between the United States and China was ready to start. As for Japan’s macroeconomic data released on Friday, it was mixed. Household spending fell 3.9% in May from a year ago. The actual drop was bigger than a 1.5% decline predicted by analysts and the 1.3% fall registered […]

Read more July 6

July 62018

Japanese Yen Falls After Mixed Data, Risk Aversion Provides No Help

The Japanese yen was flat against the US dollar and fell versus other major currencies today despite the gloomy mood among investors as the trade war between the United States and China was ready to start. As for Japan’s macroeconomic data released on Friday, it was mixed. Household spending fell 3.9% in May from a year ago. The actual drop was bigger than a 1.5% decline predicted by analysts and the 1.3% fall registered […]

Read more July 6

July 62018

NZ Dollar Rallies for Fourth Day in a Row

The New Zealand dollar rallied today, rising for the fourth consecutive trading session against some of its rivals, including the US dollar and the euro. Analysts are not overly optimistic for the currency, though, saying that it was likely just a relief rally. Indeed, the kiwi has started a decline a month ago, therefore an upward correction was not unexpected. The current environment on the Forex market is not supportive to riskier currencies […]

Read more