Current Developments – USD Tops After FOMC Minutes

The US Dollar finished Thursday’s session rather mixed having experienced losses during the first half followed by gains in the second. During the former, its weakness may have been due to broad Euro strength as the ECB increased hawkish monetary policy bets. Then, news that the US proposed eliminating auto import tariffs on both sides of the Atlantic added more momentum to Euro gains and the DAX.

In the second half, the US Dollar advanced along with local front-end government bond yields. During its climb, better-than-expected ISM Non-Manufacturing data did not hurt. Simultaneously, US stocks came online after the Independence Day holiday and Wall Street finished the day higher. The S&P 500 rose about 0.86 percent.

The release of the FOMC minutes did put a halt to the greenback’s ascent, though it certainly gained temporarily as the statement crossed the wires. There, Fed officials saw gradual rate hikes as needed given a ‘very strong’ economy. However, most members noted that there are intensified risks around trade policy. Increasing concerns on this front may have contributed to USD’s top.

Notes from the FOMC Minutes:

- Gradual hikes needed amid ‘very strong’ economy

- Most Fed officials saw intensified risks around trade policy

- Fed minutes show broad support for gradual rate hikes

- A few Fed officials saw US fiscal policy as an upside risk

- Many business contacts are concerned by risks from a trade war

- Price moves support outlook for 2% inflation

- A number of Fed officials said it is premature to declare victory on inflation

- Some businesses are passing higher costs to consumers

- Fed officials saw fiscal policy supporting economic growth

A Look Ahead – Trade War Looming?

Speaking of rising concerns round trade policy, US President Donald Trump confirmed that the country will go ahead with imposing the first portion of the $50b in Chinese import tariffs at midnight local time. This translates to $34b around 4:00 GMT on Friday. China is at this point ready to retaliate and yesterday, Commerce Ministry Spokesman Gao Feng confirmed it.

As such, while Asian shares may have some scope for gains given Wall Street’s performance, those might be mitigated to a certain extent. Keep in mind that a few weeks ago, Donald Trump has threatened to impose additional levies on China in the event that they retaliate. If stocks do climb in the interim, there may be a nasty surprise down the road as such. Either way, anti-risk currencies and sentiment-linked ones like the Japanese Yen and Australian/New Zealand Dollars respectively could be volatile.

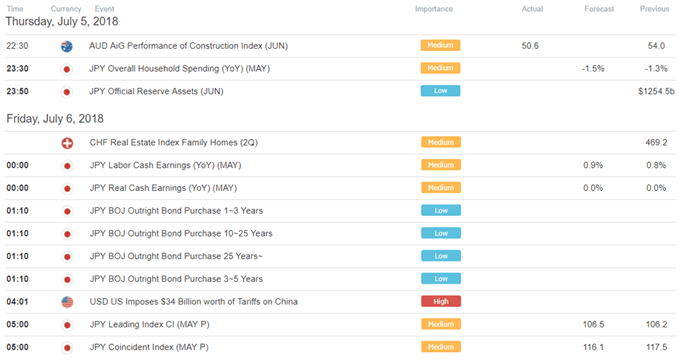

DailyFX Economic Calendar: Asia Pacific (all times in GMT)

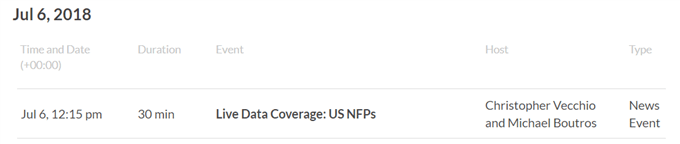

DailyFX Webinar Calendar – CLICK HERE to register (all times in GMT)

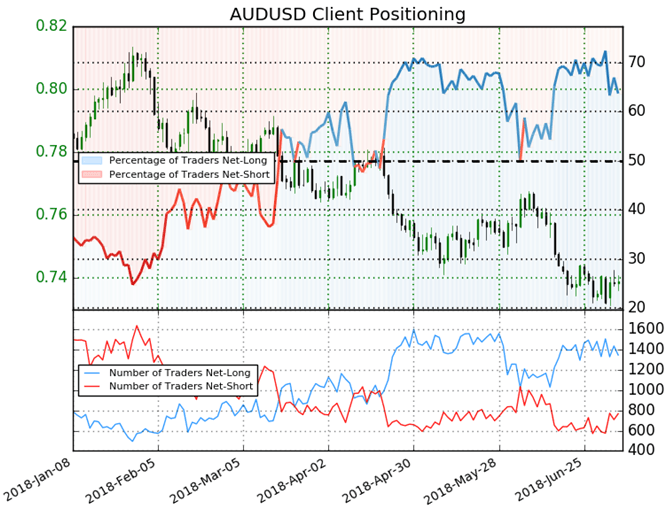

IG Client Sentiment Index Chart of the Day: AUD/USD

CLICK HERE to learn more about the IG Client Sentiment Index

Retail trader data shows 63.7% of traders are net-long with the ratio of traders long to short at 1.76 to 1. In fact, traders have remained net-long since Jun 05 when AUD/USD traded near 0.75665; price has moved 2.4% lower since then. The number of traders net-long is 2.2% lower than yesterday and 7.2% lower from last week, while the number of traders net-short is 6.7% higher than yesterday and 12.3% higher from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests AUD/USD prices may continue to fall. Yet traders are less net-long than yesterday and compared with last week. Recent changes in sentiment warn that the current AUD/USD price trend may soon reverse higher despite the fact traders remain net-long.

Five Things Traders are Reading:

- China Says ’Ready to Fight’ in the Trade War on Eve of US Tariff Hit by Renee Mu, Currency Analyst

- Central Bank Weekly: GBP, CAD Rebound as BOE, BOC Rate Hike Odds Rise by Christopher Vecchio, CFA, Sr. Currency Strategist

- NZD/USD to Stage Larger Rebound as RSI Flashes Buy Signal by David Song, Currency Analyst

- Pre-NFP Price Action Setups Across the US Dollarby James Stanley, Currency Strategist

- Weekly Technical Perspective on the Australian Dollar (AUD/USD)by Michael Boutros, Currency Strategist

— Written by Daniel Dubrovsky, Junior Currency Analyst for DailyFX.com

To contact Daniel, use the comments section below or @ddubrovskyFX on Twitter