Talking Points:

- Canadian unemployment for June rests at 6.0%, increasing 0.2 percentage points from May

- The Canadian dollar climbed versus the dollar as unemployment similarly ticked higher in the US

- Trade remains a pivotal topic for the Canadian economy as NAFTA remains unresolved and metal tariffs in place

- Bank of Canada’s rate decision is scheduled next week on Wednesday, July 11th at 14:00 GMT

Gain insight on market moving events from our Live Webinars and learn to trade more effectively with our Free Trading Guides.

The Canadian dollar drew pressure this morning after June employment figures were released and modestly fell short of expectations. The Loonie subsequently saw significant volatility versus the Greenback but eventually leveled off slightly higher. Canadian unemployment for June was 6.0% versus a forecasted 5.8% which was also the level of unemployment for the previous month. Although 31,800 jobs were added in the month, the increase was not enough to ward off an increase in participation. The miss adds further uncertainty to the direction the Bank of Canada will take next week at its rate decision, where probabilities of a hike stood near 50/50 before the data release. The key interest rate currently rests at 1.25%; and for Canada, this is the first time unemployment has ticked above 6% since last October when it read 6.2%.

Stay up to date with important economic data with our Economic Calendar.

Although a NAFTA member and close ally, Canada has faced steel and aluminum tariffs from the United States since June 1st. The tariffs may begin to have a tangible impact on employment for both nations, but further evidence is needed before a concrete claim can be made. Despite this, US President Donald Trump has ordered the Commerce Department to investigate the impact of auto tariffs, a move that would greatly impact the Canadian dollar if implemented. At the same time, a key Canadian export in crude oil has been subject to volatility this week following a slew of comments from various OPEC members and US President Trump. After agreeing to increase production, Saudi Arabia erased recent gains up to $75 a barrel to where it currently resides around $72.

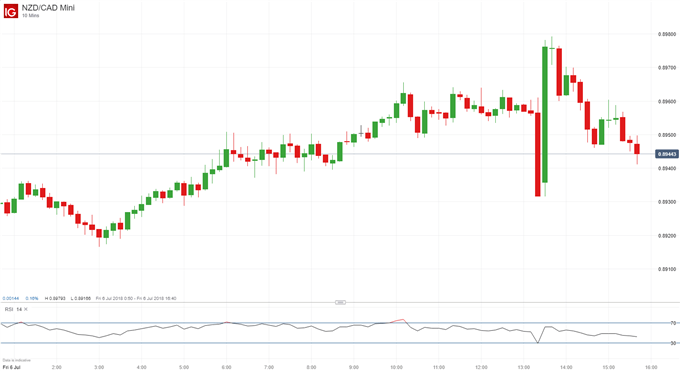

As we look to markets, the impact of the unemployment figures on the Canadian dollar seems to be overshadowed by the United States’ own unemployment miss, reading in at 4.0% in June versus an expected 3.8%. A much larger market, the Greenback took a hit and dove lower early Friday, leaving USD/CAD around 1.3097. Compared to other pairs, the loonie showed similar resilience. Versus the New Zealand dollar, significant volatility was seen upon release but the loonie has since recovered all the lost ground and trades higher than pre-release, near 0.8945. The next key event risk for the Canadian dollar will be on July 11th at the Bank of Canada’s rate decision.

Chart 1: USD/CAD, 10-Minute July 6

Chart 2: NZD/CAD, 10-Minute July 6

—Written by Peter Hanks, DailyFX Research