NFP Analysis and Talking Points

- US Nonfarm Payrolls rose by 213k in June, beating expectations of 195k expected; Prior month revised higher.

- US Average Hourly Earnings misses forecasts.

- US Unemployment Rate shows surprise 0.2ppt rise amid boost in participation rate

See our latest Q3 FX forecast to learn what will drive the currency through the quarter.

NFP Report Review

US Bureau of Labor Statistics reported total nonfarm payroll (NFP) employment expanded by a 213k jobs in June, which rose above expectations of 195k. Additionally, the headline figure saw an upward revision to 244k from 223k, while the 2-month net revision had been +37k. However, the US unemployment rate rose 0.2ppts from 20yr lows to 4%, which underwhelmed expectations of 3.8%.

Wage Data Misses Estimates

The Fed focussed wage data had fallen short of expectations with the M/M at a meagre 0.2% (Exp. 0.3%), leaving a Y/Y rate unchanged at 2.7% (Exp. 2.8%). As such, this reduces fears of a potential overshoot in inflation with the figures suggesting that there is only a modest build in inflation pressures in the US economy. Overall, the jobs report does not change the outlook for the Federal Reserve with the central bank likely to implement 2 more rate hikes in September and December.

Market Response

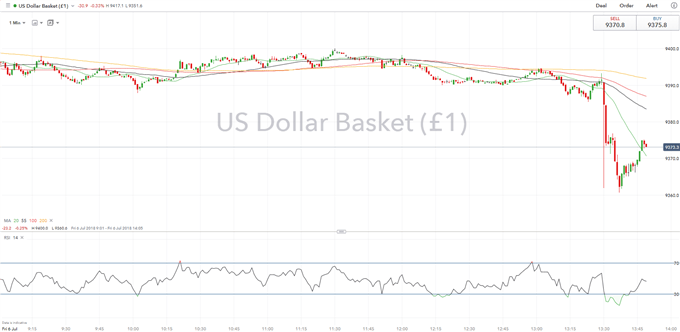

In an immediate response to the report, the USD index fell to session weaker lows on the back of the rising unemployment rate and wage data, given that the latter has been more significant for the Fed with regard to monetary policy in recent times. However, the fact that this does not significantly change the outlook for the FOMC with the CME Fed Fund Futures showing a 50% chance of 2 more rate hikes this year. As such, the initial USD softness is unlikely to extend, while the headline payrolls also continued to show a robust figure.

DXY Price Chart 1: 1-minute time frame (Intra-day)

— Written by Justin McQueen, Market Analyst

To contact Justin, email him at Justin.mcqueen@ig.com

Follow Justin on Twitter @JMcQueenFX