EUR Analysis and Talking Points

- InvestorMorale Bounces, However, Trade Tensions Could Depress Sentiment Again

- GermanTrade Surplus Widens on Rising Exports

See our Q3 EUR forecast to learn what will drive the currency through the quarter.

Investor Morale Bounces, However, Trade Tensions Could Depress Sentiment Again

Eurozone Sentix Investor Confidence rose to 12.1 in July, ending a run of five consecutive monthly declines, which also came ahead of expectations of 8.2. However, despite the bounce in morale, Sentix stated that escalating trade tensions with the US risks depressing sentiment again, adding that if President Trump targets the European car industry, the trade spat could lead to a more pronounced slowdown in economic sentiment. Elsewhere, the Sentix survey for Germany saw investor morale fall from 16.2 from 18.5, marking the 6th consecutive decline, reaching its lowest level since February 2016.

German Trade Surplus Widens on Rising Exports

Germany’s trade surplus widened more than expected at EUR 20.3bln, against consensus for EUR 20bln. This had largely been due to the better than expected exports reading at 1.8% (Exp. 0.75%). Consequently, this signals a boost for the German economy after the recent setback in prior months.

The Euro is on the front foot this morning with EURUSD up a modest 0.2%, largely on the back of the weaker USD, which has continued to pullback against its major counterparts. While the overall encouraging data in the Eurozone has also buoyed the currency.

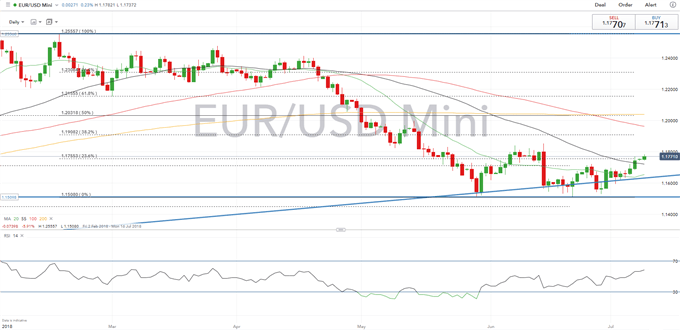

EURUSD PRICE CHART: Daily Time-Frame (February 2018-July 2018)

IG Client Positioning states that the combination of current sentiment and recent changes gives us a stronger EURUSD-bullish contrarian trading bias. For full client positioning click here

— Written by Justin McQueen, Market Analyst

To contact Justin, email him at Justin.mcqueen@ig.com

Follow Justin on Twitter @JMcQueenFX