GBPUSD Analysis and News

- Sterling Rises on Soft Brexit Hopes, Coupled with USD Weakness

- Brexit Minister David Davies Resignations Puts a Lid on Initial Gains

See our latest Q3 FX forecast to learn what will drive the currency through the quarter.

See how retail traders are positioning in GBPUSD as well as other major FX pairs on an intraday basis using the DailyFX speculative positioning data on the sentiment page.

GBP Rises on Soft Brexit Hopes

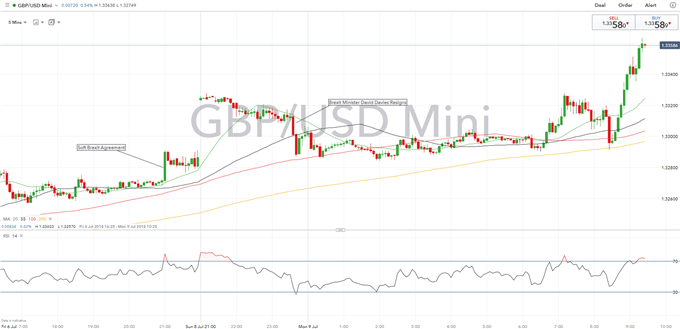

On Friday, PM May’s “soft” Brexit plan had been agreed among cabinet ministers at the Chequers meeting, which led to a move higher in the Pound against its major counterparts with GBPUSD rising above 1.33. The plan for the new UK-EU free trade area involves the UK having a customs regime around the bloc’s rules and implement identical regulations for certain sectors.

Prolonged Brexit Uncertainty Caps Gains

However, resignations overnight from Brexit Minister David Davies and two additional government ministers’ casts doubts on the plan and the ability for the UK to get a deal done by the October EU meeting. David Davies argued in his resignation letter that the agreement made it less and less likely that the manifesto commitment to leave the customs union and the single market will be delivered. As such, the resignation led to weakness in GBPUSD which slipped back below 1.33, however, the broad USD weakness has since provided a recovery in the pair.

Overall, prolonged Brexit uncertainty poses downside risks to the Pound, however, given the support for soft Brexit plans, this suggests that risks are titled to the upside. Eyes will be on PM May who is due to address the parliamentary party later today, while a White Paper on the Brexit agreement is due to be published later this week (Thursday/Friday).

GBP/USD PRICE CHART: 5-MINUTE TIME FRAME (July 6-July 9)

— Written by Justin McQueen, Market Analyst

To contact Justin, email him at Justin.mcqueen@ig.com

Follow Justin on Twitter @JMcQueenFX