Talking Points:

- New Zealand Dollar rose after local credit card spending beat

- NZD mirrored market sentiment as global stocks posted gains

- The currency pair eyes risk trends and CPI data for next move

Find out what retail traders’ New Zealand Dollar buy and sell decisions say about the coming price trend!

The New Zealand Dollar appreciated against its US counterpart ahead of Tuesday’s Asia Pacific trading session. Its upside momentum was accelerated in the aftermath of better than expected local monthly retail credit card spending data.

Purchases increased 0.8% versus +0.5% estimated and May’s 0.6% increase. However, the data had a limited impact on RBNZ monetary policy bets, as local two-year government bond yields were largely unchanged. Keep in mind, the reserve bank is awaiting stable 2% inflation as it contemplates a rate change in either direction.

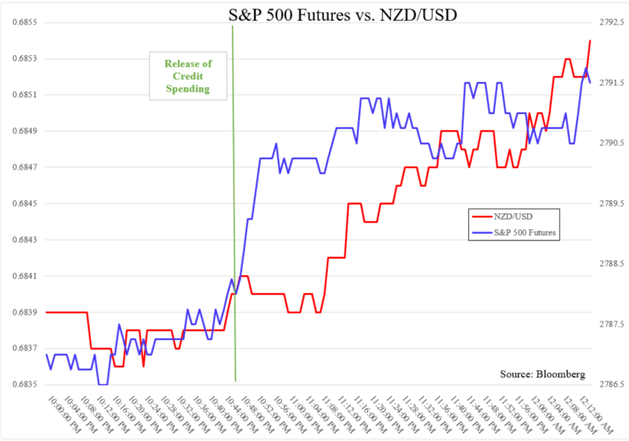

New Zealand’s currency appeared to be more interested in developments in risk trends, rather. S&P 500 futures rose heading into Tuesday’s Asia Pacific trading session, following positive worldwide stock performance. Due to NZD’s relatively higher associated yield in the major FX spectrum, the currency tends to closely follow market sentiment.

Looking ahead, risk trends may impact whether NZD/USD continues its rally, more so than New Zealand economic data. On this front, UK political uncertainty and the US-China trade war is likely to influence the relatively riskier New Zealand Dollar. In the long run, the Reserve Bank of New Zealand will be closely looking at an upcoming second quarter CPI data release which will be on July 16th.

S&P 500 Futures vs. NZD/USD (All times listed in GMT)

NZD/USD Trading Resources

- Join a free Q&A webinar and have your trading questions answered

- Just getting started? See our beginners’ guide for FX traders

- Having trouble with your strategy? Here’s the #1 mistake that traders make

- See our free guide to learn what are the long-term forces driving NZD prices

— Written by Daniel Dubrovsky, Junior Currency Analyst, and Megha Torpunuri, DailyFX Research Team