We just released our 3Q forecasts for currencies like the anti-risk Japanese Yen in the DailyFX Trading Guides page

Current Market Developments – Lull in Trade War Updates Ends as S&P 500 Futures Tumble

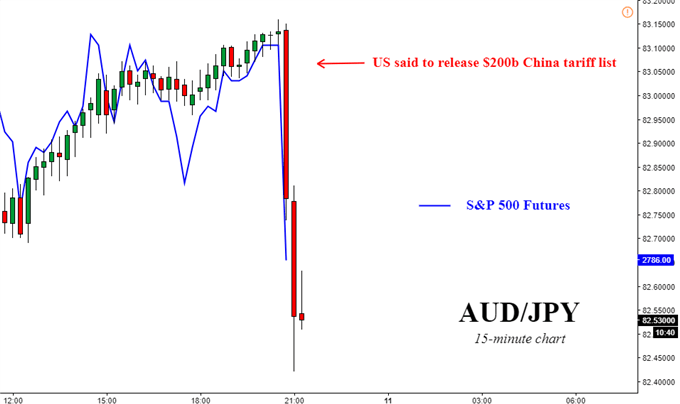

It was another solid day in global stock markets as indexes generally rose in Europe and in the US on Tuesday amidst a lack of trade war updates. A lack of updates on this front however is over. As the markets transitioned into Wednesday’s session, reports crossed the wires that the United States is getting ready to publish the additional $200b list in Chinese import tariffs.

This response is not surprising. After the world’s largest economy went ahead with imposing the first portion of the $50b in Chinese levies last week ($34b), the impacted country quickly retaliated with their own list. In past spats, President Donald Trump had threatened to push with more taxes on Chinese goods in the event of retaliation.

BACKGROUND: A Brief History of Trade Wars, 1900-Present

S&P 500 futures tumbled close to around 0.75 percent and the index could well erase the gains that helped push it to its highest close since February 2nd on Tuesday. In the FX spectrum, the anti-risk Japanese Yen appreciated swiftly while sentiment-linked currencies like the Australian and New Zealand Dollars tumbled. This combination sent AUD/JPY falling more than one percent.

AUD/JPY Reaction to US $200b Chinese Import Tariffs list

Chart created in TradingView

A Look Ahead – Asian Stocks Set to Fall

Given how this updates crossed the wires in-between the transition from the US into Asian market hours, there could be aggressive declines in local benchmark indexes at market open. The progress to the upside recently seen in the ASX 200 could be reversed. Japan’s Nikkei 225 could also fall, turning around to potentially face lows set back earlier this month around 21,670.

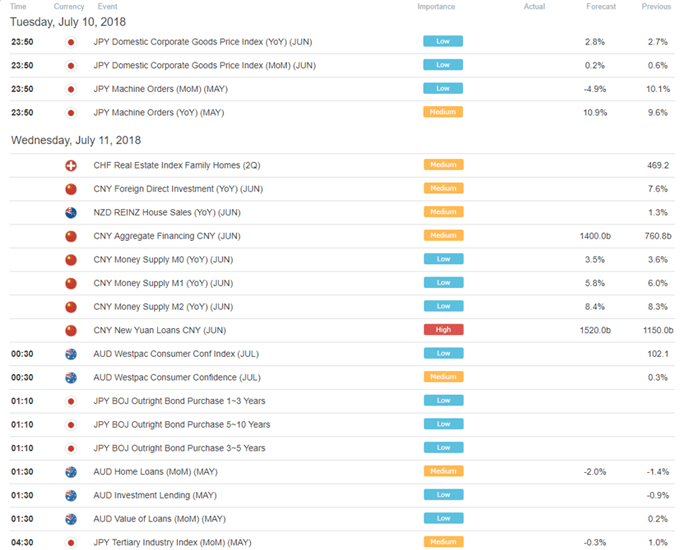

A lack of major economic event during Wednesday’s Asian trading session also allows for risk trends to continue brewing. In the event of local shares extending losses, the Japanese Yen could have more room to climb while the Australian and New Zealand Dollars descend. This dynamic could particularly be accelerated once China inevitably retorts.

DailyFX Economic Calendar: Asia Pacific (all times in GMT)

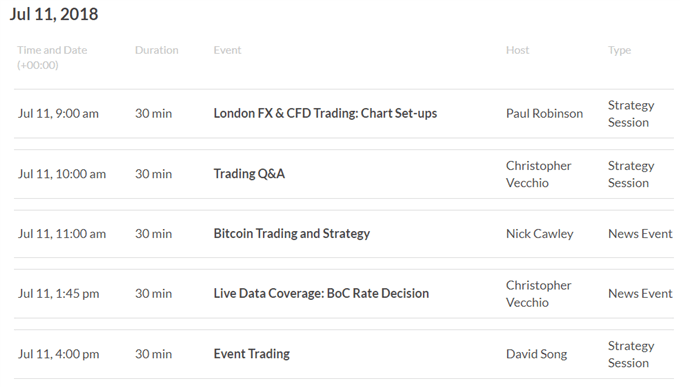

DailyFX Webinar Calendar – CLICK HERE to register (all times in GMT)

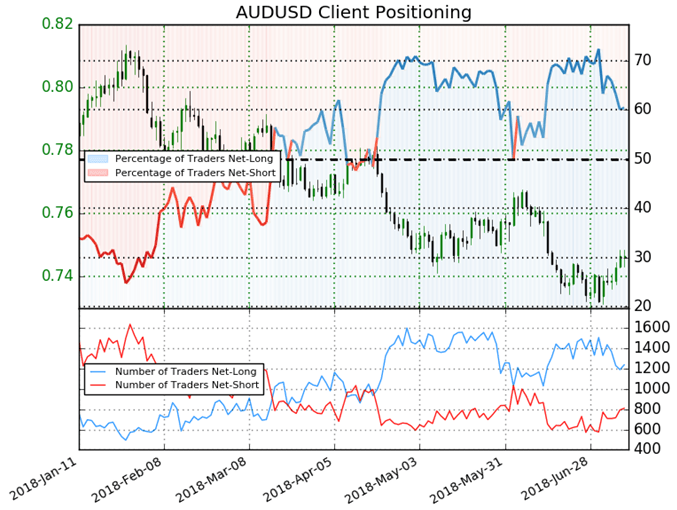

IG Client Sentiment Index Chart of the Day: AUD/USD

CLICK HERE to learn more about the IG Client Sentiment Index

Retail trader data shows 60.5% of AUD/USD traders are net-long with the ratio of traders long to short at 1.53 to 1. In fact, traders have remained net-long since Jun 05 when AUD/USD traded near 0.75729; price has moved 1.4% lower since then. The number of traders net-long is 0.2% lower than yesterday and 5.1% lower from last week, while the number of traders net-short is 0.1% lower than yesterday and 2.6% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests AUD/USD prices may continue to fall. Yet traders are less net-long than yesterday and compared with last week. Recent changes in sentiment warn that the current AUD/USD price trend may soon reverse higher despite the fact traders remain net-long.

Five Things Traders are Reading:

- Gold Price Outlook Mired by Extreme Retail Positioning David Song, Currency Analyst

- US Dollar Pullback Can Cut Both Ways: USD Price Action Setups by James Stanley, Currency Strategist

- Weekly Technical Perspective on the British Pound (GBP/USD) by Michael Boutros, Currency Strategist

- USD/JPY Technical Outlook: Price Rally Approaching Critical Resistance by Michael Boutros, Currency Strategist

- EUR Technical Analysis Overview: Short Term Euro Softness, Long Term Gainby Justin McQueen, Analyst

— Written by Daniel Dubrovsky, Junior Currency Analyst for DailyFX.com

To contact Daniel, use the comments section below or @ddubrovskyFX on Twitter