Bitcoin, Ripple, Ether, Litecoin Price Analysis

- The cryptocurrency market needs some fundamental drivers to push prices higher.

- Ripple (XRP) remains a binary SEC play and movement either way likely to be volatile.

- Low volumes but Tether (USDT) pair trading noticeable.

IG Client Sentimentshows how retail clients are currently positioned in a wide range of cryptocurrencies and how positioning has changed over the last week – and data show retail are overwhelmingly long.

Cryptocurrency Prices Continue to Test Technical Support Levels

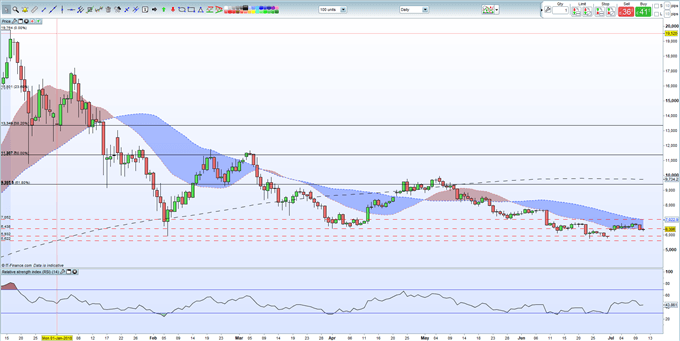

A lack of any good news continues to weigh on the cryptocurrency sector, keeping prices constrained by previous support levels. Any relief rallies are met by renewed selling interest leaving the charts looking neutral to negative overall. Ripple (XRP) continues to trade in the early-to-mid $0.40 area and is unlikely to make a break until the SEC decides/announces if the token is classified as a security or not. Overall turnover in the market remains low, although Tether (USDT) pair trading remains conspicuous across many exchanges. Looking ahead, cryptocurrencies need to break back above previous support levels to give bulls a positive signal, but in the meantime lower prices look likely in the short-term.

Bitcoin (BTC) Daily Price Chart Showing Important Levels (December 2017 – July 11, 2018)

Cryptocurrency Trader Resources – Free Practice Trading Accounts, Guides, Sentiment Indicators and Webinars

If you are interested in trading Bitcoin (BTC), Ripple (XRP), Bitcoin Cash (BCH), Litecoin (LTC) or Ethereum (ETH) we can offer you a wide range of free resources to help you. We have an Introduction to Bitcoin Trading Guide along with a Free Demo Account. In addition we run a Weekly Bitcoin Webinar to help you keep in touch with the market and make more informed trading decisions.

What’s your opinion on the latest cryptocurrency moves? Share your thoughts and ideas with us using the comments section at the end of the article or you can contact me on Twitter @nickcawley1 or via email at nicholas.cawley@ig.com.

— Written by Nick Cawley, Analyst.