- December 21, 2020 Do we get tax benefits on Personal Loan?

- December 18, 2020 The solicitors Preston depends on for stress-free compensation claims

- December 16, 2020 eToro: History and Key Features

- December 11, 2020 Canadian Dollar Pauses 2020 Rally Against US Peer Amid Falling Crude Prices

- December 11, 2020 Pound Crashes Against Dollar As No-Deal Brexit Appears Imminent

- December 11, 2020 USD/JPY 104.57 High Starting a New Bearish Leg?

Day: July 25, 2018

July 25

July 252018

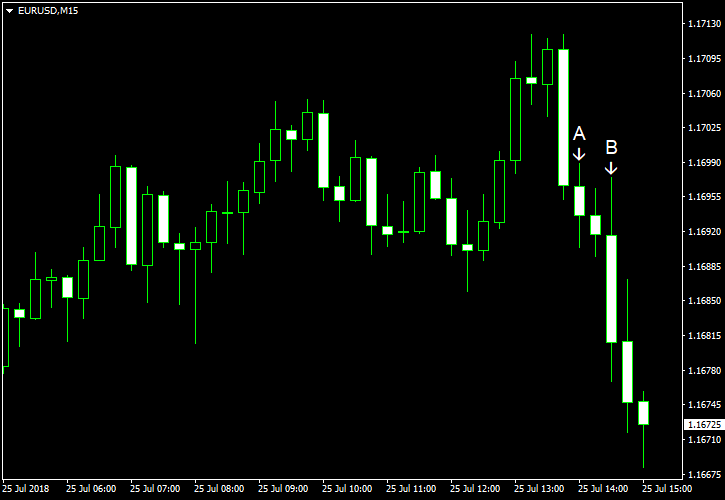

EUR/USD Consolidates Ahead of ECB Meeting

EUR/USD attempted to rally today but has retreated to the opening level by now. Traders wait for the outcome of talks between US President Donald Trump and European Commission President Jean-Claude Juncker, who will try to avoid starting trade wars, but many experts do not believe that the meeting will bring any meaningful results. Market participants also wait for tomorrow’s meeting of the European Central Bank. New home […]

Read more July 25

July 252018

US Dollar Posts Losses After Underwhelming Data

The US dollar was somewhat soft today, logging losses against most other major currencies. Market analysts blamed underwhelming domestic data and the threat of trade wars for the decline. The current trading session was light on economic releases from the United States, and the one that happened was disappointing. New home sales fell to 631,000 in June from the May’s negatively revised 666,000. Following the release, the Spot Dollar Index slipped […]

Read more July 25

July 252018

US Dollar Posts Losses After Underwhelming Data

The US dollar was somewhat soft today, logging losses against most other major currencies. Market analysts blamed underwhelming domestic data and the threat of trade wars for the decline. The current trading session was light on economic releases from the United States, and the one that happened was disappointing. New home sales fell to 631,000 in June from the May’s negatively revised 666,000. Following the release, the Spot Dollar Index slipped […]

Read more July 25

July 252018

Chinese Yuan Weakens to 13-Month Low After Beijing Pledges Stimulus

The Chinese yuan fell to its lowest level since June 2017 after the federal government vowed to adopt a more proactive fiscal initiative, reversing a previous policy of winding down stimulus efforts and unloading debt. This comes as the US government promised it would keep a close eye on potential currency manipulation by the world’s second-largest economy. Earlier this week, Chinaâs cabinet, the State Council, indicated that it will introduce […]

Read more July 25

July 252018

Chinese Yuan Weakens to 13-Month Low After Beijing Pledges Stimulus

The Chinese yuan fell to its lowest level since June 2017 after the federal government vowed to adopt a more proactive fiscal initiative, reversing a previous policy of winding down stimulus efforts and unloading debt. This comes as the US government promised it would keep a close eye on potential currency manipulation by the world’s second-largest economy. Earlier this week, Chinaâs cabinet, the State Council, indicated that it will introduce […]

Read more July 25

July 252018

Rising Crude Oil Prices Benefit Canadian Dollar

The Canadian dollar rallied today. The rally was likely a result of the rising prices for crude oil — Canada’s major export commodity, which often has a big impact on the performance of the loonie. With almost no domestic macroeconomic data to drive the Canadian currency this week, it had to look elsewhere. As it often happens, crude oil provided a direction for the loonie, this time dragging it along to the upside. Crude gained after […]

Read more July 25

July 252018

Rising Crude Oil Prices Benefit Canadian Dollar

The Canadian dollar rallied today. The rally was likely a result of the rising prices for crude oil — Canada’s major export commodity, which often has a big impact on the performance of the loonie. With almost no domestic macroeconomic data to drive the Canadian currency this week, it had to look elsewhere. As it often happens, crude oil provided a direction for the loonie, this time dragging it along to the upside. Crude gained after […]

Read more July 25

July 252018

EUR/USD Consolidates Ahead of ECB Meeting

EUR/USD attempted to rally today but has retreated to the opening level by now. Traders wait for the outcome of talks between US President Donald Trump and European Commission President Jean-Claude Juncker, who will try to avoid starting trade wars, but many experts do not believe that the meeting will bring any meaningful results. Market participants also wait for tomorrow’s meeting of the European Central Bank. New home […]

Read more July 25

July 252018

Euro Rallies Slightly on German IFO Survey Ahead of EU-US Trade Talks

The euro today rallied higher following the release of the German IFO survey in the early European session, which beat expectations slightly. The pair’s upside was largely limited by the impending trade talks between the USA and the European Union delegation in Washington scheduled for later today. The EUR/USD currency pair today traded in a tight range marked with a high of 1.1705 and a low of 1.1674. The currency pair’s slight rally was triggered by the release of the German IFO […]

Read more July 25

July 252018

Euro Rallies Slightly on German IFO Survey Ahead of EU-US Trade Talks

The euro today rallied higher following the release of the German IFO survey in the early European session, which beat expectations slightly. The pair’s upside was largely limited by the impending trade talks between the USA and the European Union delegation in Washington scheduled for later today. The EUR/USD currency pair today traded in a tight range marked with a high of 1.1705 and a low of 1.1674. The currency pair’s slight rally was triggered by the release of the German IFO […]

Read more