- December 21, 2020 Do we get tax benefits on Personal Loan?

- December 18, 2020 The solicitors Preston depends on for stress-free compensation claims

- December 16, 2020 eToro: History and Key Features

- December 11, 2020 Canadian Dollar Pauses 2020 Rally Against US Peer Amid Falling Crude Prices

- December 11, 2020 Pound Crashes Against Dollar As No-Deal Brexit Appears Imminent

- December 11, 2020 USD/JPY 104.57 High Starting a New Bearish Leg?

Day: October 25, 2018

October 25

October 252018

US Dollar Surges Amid Mixed Economic Data

The US dollar is rallying against a basket of currencies on Thursday after the release of a mixed bag of economic data. The greenback has been trading higher over the last few trading sessions, helping the currency add to its impressive year-to-date gains. Last month, orders for durable goods rose 0.8%, the third increase in the last four months, driven by orders for defense goods and transportation. The market did anticipate a 1.9% decline after there […]

Read more October 25

October 252018

Japanese Yen Gives Away Gains Caused by Decline of Asian Stocks

The Japanese yen rallied intraday amid risk aversion caused by sell-off of Asian stocks. But the currency retreated later after most of European and US equities logged big gains. Asian stocks showed big losses today, with Japanese Nikkei 225 losing more than 3% of its value. The market sentiment worsened because of that but recovered as most of the European and US equities gained by more than 1%. As for macroeconomic […]

Read more October 25

October 252018

NZ Dollar Mixed After Trade Balance Deficit Reaches Record High

The New Zealand dollar was mixed today after falling intraday as the monthly trade balance deficit reached the highest level on record. But the bounce of global stocks supported riskier commodity currencies. Statistics New Zealand reported that the trade deficit widened from NZ$1.47 billion in August to the record high of NZ$1.56 billion. Experts had predicted a decrease to NZ$1.37 billion. NZD/USD traded at the opening of 0.6520 as of 16:37 GMT today after […]

Read more October 25

October 252018

Euro Rallies From Trading Range After ECB Decision, Later Declines

The euro today broke out of the range it was trading in for the earlier part of the session after the European Central Bank announced its monetary policy decision. The EUR/USD currency pair rallied higher after the ECB announcement where it maintained its current monetary policy direction as was expected. The EUR/USD currency pair today rallied from a low of 1.1396 to a high of 1.1432 following the ECB decision before retracing all its […]

Read more October 25

October 252018

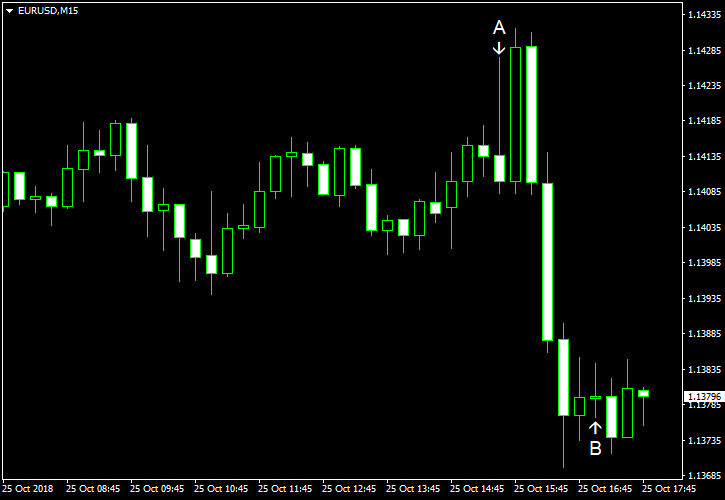

EUR/USD Unable to Keep Rally After ECB Meeting

EUR/USD rallied for a brief time following optimistic outlook expressed by European Central Bank President Mario Draghi at the press conference that followed the central bank’s policy meeting. (Event A on the chart.) The rally was extremely short-lived, though, and the currency pair has dipped below the opening level by now. US macroeconomic data released today was generally good but had limited impact on the Forex market. Durable goods orders rose […]

Read more