- December 21, 2020 Do we get tax benefits on Personal Loan?

- December 18, 2020 The solicitors Preston depends on for stress-free compensation claims

- December 16, 2020 eToro: History and Key Features

- December 11, 2020 Canadian Dollar Pauses 2020 Rally Against US Peer Amid Falling Crude Prices

- December 11, 2020 Pound Crashes Against Dollar As No-Deal Brexit Appears Imminent

- December 11, 2020 USD/JPY 104.57 High Starting a New Bearish Leg?

Day: November 14, 2018

November 14

November 142018

US CPI Accelerates Within Expectations, US Dollar Index Falls Slightly

The US dollar gained on some of its major rivals, including the euro and the Great Britain pound, after consumer inflation in the United States accelerated in line with market expectations. Overall, though, the currency traded slightly lower. The headline US CPI increased 0.3% in October from the previous month, exactly as analysts had forecast, after rising 0.1% in September. The core CPI rose 0.2%, also matching forecasts, after increasing 0.1% […]

Read more November 14

November 142018

Chinese Yuan Rises Despite Disappointing Economic Data

The Chinese yuan is gaining against its American counterpart midweek, despite a myriad of disappointing economic numbers that show the national economy is not on strong footing. It is evident by now that Beijing will be unable to weather the storm clouds forming from the US-China trade war. According to the National Bureau of Statistics (NBS), consumer spending on automobiles and staple foods expanded 8.6%, the slowest pace in five months […]

Read more November 14

November 142018

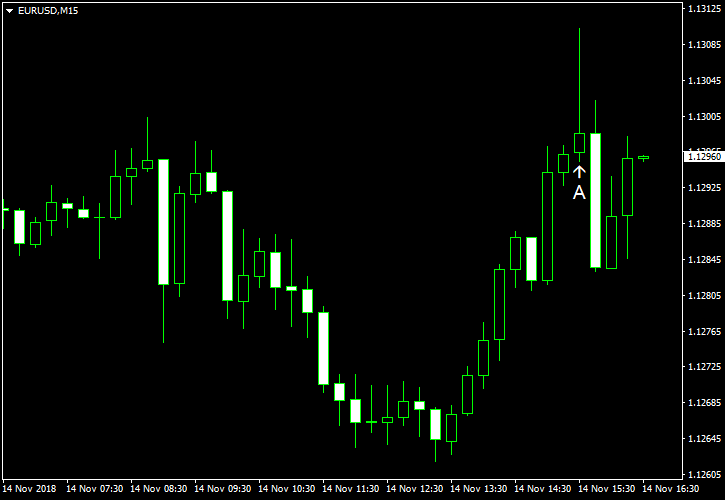

EUR/USD Demonstrates Volatile Reaction to US CPI

EUR/USD reacted with volatility to the US Consumer Price Index, which came out within expectations. Initially, the currency pair spiked but retreated very quickly, demonstrating a sharp pullback. CPI rose 0.3% in October, matching analysts’ forecasts exactly. The index increased 0.1% in September. (Event A on the chart.) Yesterday, a report on treasury budget was released, showing a deficit of $100.5 billion in October, which was smaller than the shortage of $116.6 […]

Read more November 14

November 142018

Pound Falls on UK Political Uncertainty Amid Weak Inflation Data

The Sterling pound today traded lower against the US dollar as markets awaited the crucial meeting between the British PM Theresa May and her cabinet to approve the draft Brexit deal. The pound declined further following the release of weak UK consumer price index report in the early London session, which further soured investor sentiment towards the Sterling. The GBP/USD currency pair today dropped from an opening high of 1.3025 to a low of 1.2886 […]

Read more November 14

November 142018

Euro Falls on Weak German GDP Growth as Italian Crisis Persists

The euro today fell significantly against the US dollar following the release of weak German GDP growth data in the early European session. The single currency’s decline was further accelerated by the risk-off market sentiment as investors waited for the resolution of the ongoing Italian budget crisis. The EUR/USD currency pair today fell from an Asian session high of 1.1319 to a low of 1.1264 in the mid-European session. The currency pair opened today’s session on a downtrend due to the ongoing […]

Read more November 14

November 142018

Aussie Reacts Negatively to China’s Disappointing Retail Sales

The Australian dollar attempted to rally during the Wednesday’s trading session but fell later. Some market analysts attributed the decline to the worse-than-expected retail sales in China. China’s macroeconomic data often has strong impact on the Australian currency because China is Australia’s biggest trading partner. Economic reports released in Australia itself over the current session were good. The National Bureau of Statistics of China released a range of macroeconomic indicators today. […]

Read more November 14

November 142018

Yen Drops on Slowing Economic Growth, Trims Losses Later

The Japanese yen dropped intraday as most macroeconomic reports released in Japan today were disappointing. By now, though, the currency has trimmed its losses, erasing them against some rivals outright. Japan’s gross domestic product fell 0.3% in the third quarter of this year from the previous three months. The drop followed the 0.8% increase registered in the preceding quarter. The GDP Deflator dropped 0.3% year-on-year after showing no change […]

Read more