- December 21, 2020 Do we get tax benefits on Personal Loan?

- December 18, 2020 The solicitors Preston depends on for stress-free compensation claims

- December 16, 2020 eToro: History and Key Features

- December 11, 2020 Canadian Dollar Pauses 2020 Rally Against US Peer Amid Falling Crude Prices

- December 11, 2020 Pound Crashes Against Dollar As No-Deal Brexit Appears Imminent

- December 11, 2020 USD/JPY 104.57 High Starting a New Bearish Leg?

Day: November 21, 2018

November 21

November 212018

Euro Rallies on Dovish Fed Rumors, Declines Despite Weak US Data

The euro today rallied higher against the US dollar in the mid-European session following rumors that the US Federal Reserve would pause its rate hikes in Spring 2019. The euro had rallied higher in the early European session after Italy’s Deputy Prime Minister Matteo Salvini teased that his government was willing to make revisions to its 2019 budget. The EUR/USD currency pair today rallied from a low of 1.1363 […]

Read more November 21

November 212018

Canadian Dollar Rebounds From Five-Month Low Amid Crude Oil Rally

The Canadian dollar is rebounding from its lowest level in five months on Wednesday as crude oil prices are rallying about 2%. The loonieâs gains were capped by recent dovish comments by a senior Bank of Canada (BOC) official who warned about consumer finances amid rising interest rates. While investors wait for the US Energy Information Administration (EIA)âs weekly data and comb through industry news, crude is […]

Read more November 21

November 212018

British Pound Struggles as Markets Await May-Juncker Meeting

The British pound today struggled to find direction as investors adopted a wait and see approach towards the cable even as Theresa May is set to meet Jean-Claude Juncker later today. The pound was relatively stable as it appears that the British Prime Minister has managed to fend off a leadership challenge within her own party from Brexiteer MPs. The GBP/USD currency pair today traded in a range marked by a high of 1.2820 […]

Read more November 21

November 212018

Japanese Indices for All Industry Activity Decline, Yen Falls

The Japanese yen declined today. While macroeconomic data released in Japan during the current trading session was not good, that was unlikely the reason for the decline. Japan’s Ministry of Economy, Trade, and Industry reported that the Indices for All Industry Activity fell 0.9% in September from the previous month. The actual drop was a bit higher than the forecast 0.8%. The decline followed the gain by 0.4% in August. USD/JPY advanced from 112.75 […]

Read more November 21

November 212018

Australian Dollar Bounces After Two Days of Losses

The Australian dollar rebounded today following two days of losses despite somewhat mixed domestic macroeconomic data. Today’s bounce was not enough to counter yesterday’s decline, though. The Westpac-Melbourne Institute Leading Economic Index in Australia rose by 0.1% in October from the previous month. The September reading got a positive revision from a drop by 0.1% to zero change. At the same time, six month annualized growth rate, which indicates the likely […]

Read more November 21

November 212018

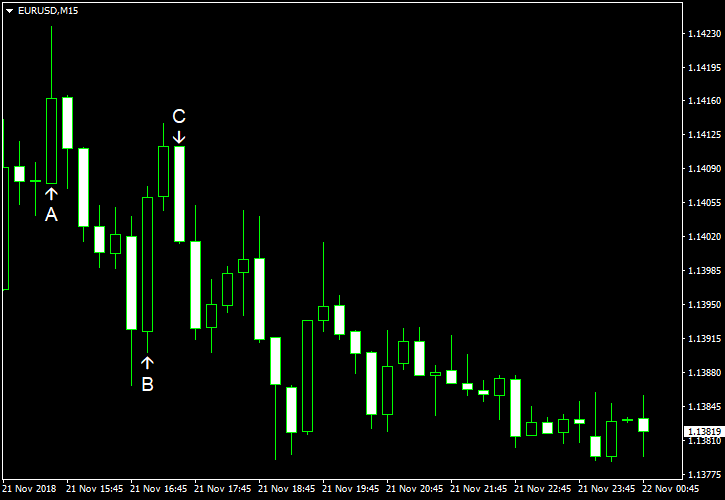

EUR/USD Trims Gains After Climbing Intraday

EUR/USD climbed today but trimmed gains by the end of the trading session. Most US macroeconomic indicators released today were below expectations but that did not help the currency pair to keep gains. Durable goods orders dropped 4.4% in October — two times the forecast decline of 2.2%. The orders rose 0.7% in September. (Event A on the chart.) Initial jobless claims were at the seasonally adjusted rate of 224k last week, above […]

Read more