EUR/USD climbed today but trimmed gains by the end of the trading session. Most US macroeconomic indicators released today were below expectations but that did not help the currency pair to keep gains.

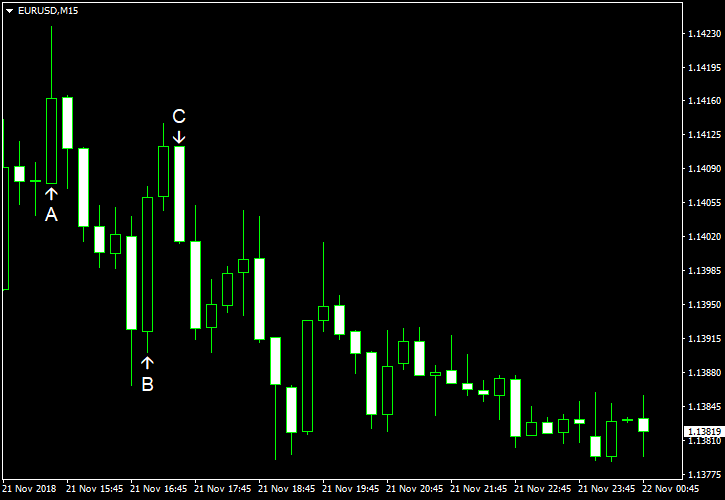

Durable goods orders dropped 4.4% in October — two times the forecast decline of 2.2%. The orders rose 0.7% in September. (Event A on the chart.)

Initial jobless claims were at the seasonally adjusted rate of 224k last week, above the forecast level of 215k. Furthermore, the previous week’s figure was revised from 216k up to 221k. (Event A on the chart.)

Michigan Sentiment Index dropped to 97.5 in November from 98.6 in October according to the revised estimate. Analysts had expected the same reading as the preliminary 98.3. (Event B on the chart.)

Leading indicators rose 0.1% in October, missing the consensus forecast of 0.2%. The increase in September got a positive revision from 0.5% to 0.6%. (Event B on the chart.)

Existing home sales were at the seasonally adjusted annual rate of 5.22 million in October, up from 5.15 million in September and above the analysts’ average forecast of 5.20 million. (Event B on the chart.)

US crude oil inventories grew by 4.9 million barrels last week and were above the five-year average for this time of year. That is compared to the forecast increase of 2.5 million barrels and the previous week’s big gain of 10.3 million barrels. Total motor gasoline inventories decreased by 1.3 million barrels but remained above the five-year average. (Event C on the chart.)

Yesterday, a report on housing starts and building permits in October was released, showing a reading of 1.23 million for housing starts and 1.26 million for building permits. That is compared to 1.21 million and 1.27 million respectively in September. (Not shown on the chart.)

If you have any comments on the recent EUR/USD action, please reply using the form below.