- December 21, 2020 Do we get tax benefits on Personal Loan?

- December 18, 2020 The solicitors Preston depends on for stress-free compensation claims

- December 16, 2020 eToro: History and Key Features

- December 11, 2020 Canadian Dollar Pauses 2020 Rally Against US Peer Amid Falling Crude Prices

- December 11, 2020 Pound Crashes Against Dollar As No-Deal Brexit Appears Imminent

- December 11, 2020 USD/JPY 104.57 High Starting a New Bearish Leg?

Day: November 27, 2018

November 27

November 272018

Chinese Yuan Weakens As Swine Fever Adds to Economic Woes

The Chinese yuan is weakening on Tuesday as new reports of African swine fever are sending economic ripples across the nationâs agricultural sector. The bearish news did not end there as industrial profits slowed in October and forecasts show growth will cool down next year. Since August, swine fever has killed approximately one million pigs, and the government has prohibited the shipment of most of the 700 million swine. This […]

Read more November 27

November 272018

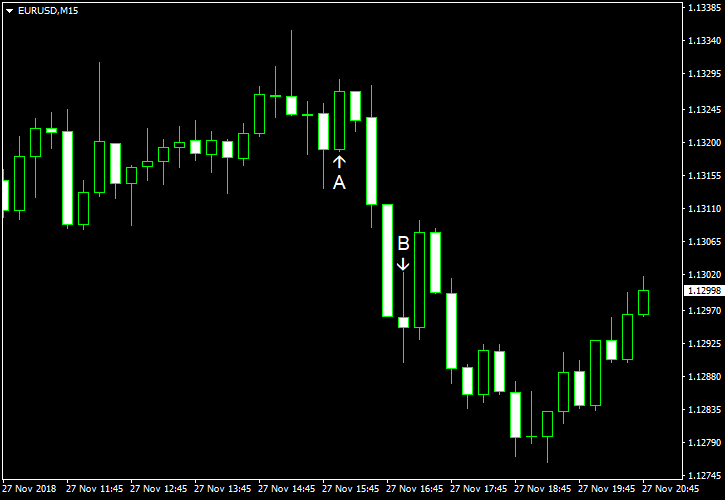

Euro Falls on Chinese Trade War News, Italy Standoff, and Trump Tariffs

The euro today was buffeted by a deluge of negative news headlines that soured investor sentiment towards the single currency and other riskier currencies. The news headlines included China’s denial of any progress in the trade war talks as well as the Italian budget standoff, which contributed to the EUR/USD currency pair’s massive decline. The EUR/USD currency pair today fell from a high of 1.1344 to a 2-week low of 1.1290 and was on a downtrend at the time of writing. The currency […]

Read more November 27

November 272018

NZ Dollar Advances Despite Worse-Than-Expected Trade Balance

The New Zealand dollar rose today despite New Zealand’s trade balance, which was released overnight, missed expectations. Statistics New Zealand reported that the trade balance deficit was at NZ$1.3 billion in October. It was a decrease from September’s deficit of NZ$1.6 billion. Nevertheless, analysts had expected even smaller deficit of NZ$0.85 billion. NZD/USD advanced from 0.6770 to 0.6803 as of 13:14 GMT today. EUR/NZD declined […]

Read more November 27

November 272018

EUR/USD Drops on Trade Tensions, Interest Rate Speculations

EUR/USD dropped today for the third consecutive day. Some analysts speculated that is because US President Donald Trump threatened additional sanctions against China, while others argued that the drop was result of comments from Federal Reserve Vice Chairman Richard Clarida, who backed the idea of additional interest rate hikes. S&P/Case-Shiller home price index rose 5.1% in September, year-on-year. That is a slower rate […]

Read more