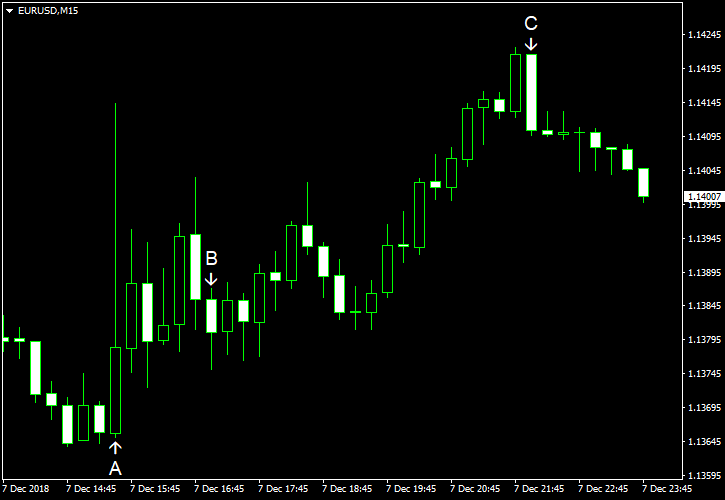

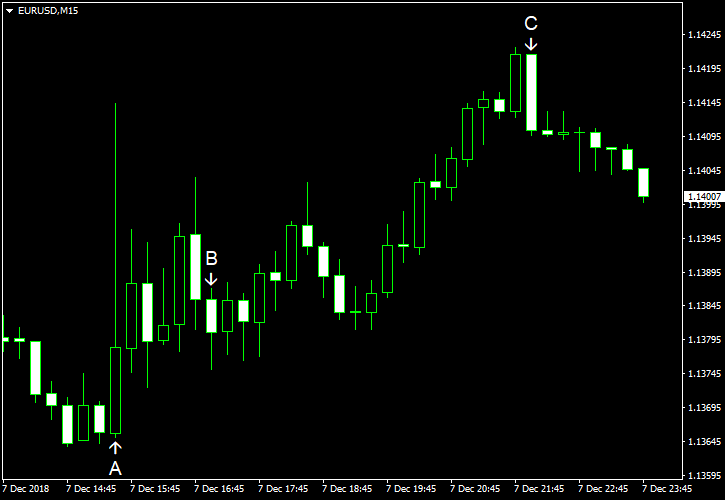

EUR/USD was volatile after US nonfarm payrolls missed expectations. Initially, the currency pair surged but trimmed gains immediately. Nevertheless, it continued to move higher afterwards. Yet by the very end of trading, the EUR/USD moved sharply down, almost erasing the day’s gains.

Nonfarm payrolls rose by just 155k in November, far below the forecast value of 198k. Furthermore, the October’s increase got a negative revision from 250k to 237k. The unemployment rate remained at 3.7%, in line with expectations. Average hourly earnings rose by 0.2%. While the increase was above the October’s negatively revised rate (0.2% before the revision), it was below the average forecast of 0.3% inflation. (Event A on the chart.)

Michigan Sentiment Index was at 97.5 in December, unchanged from November, according to the preliminary estimate. Experts had forecast a decrease to 97.0. (Event B on the chart.)

Wholesale inventories rose 0.8% in October. Economists had expected the same 0.1% rate of growth as in September. (Event B on the chart.)

Consumer credit rose by $25.4 billion in October, more than analysts had predicted — $15.1 billion. The September’s increase got a positive revision from $10.9 billion to $11.6 billion. (Event C on the chart.)

If you have any comments on the recent EUR/USD action, please reply using the form below.