- December 21, 2020 Do we get tax benefits on Personal Loan?

- December 18, 2020 The solicitors Preston depends on for stress-free compensation claims

- December 16, 2020 eToro: History and Key Features

- December 11, 2020 Canadian Dollar Pauses 2020 Rally Against US Peer Amid Falling Crude Prices

- December 11, 2020 Pound Crashes Against Dollar As No-Deal Brexit Appears Imminent

- December 11, 2020 USD/JPY 104.57 High Starting a New Bearish Leg?

Day: January 18, 2019

January 18

January 182019

Canadian Dollar Firm After Better-than-Expected CPI Release

The Canadian dollar managed to gain on most of its major rivals today, excluding the US dollar, thanks to the better-than-expected inflation print released by Statistics Canada during the trading session. The Consumer Price Index rose 2.0% in December, year-over-year. Analysts were expecting the same 1.7% increase as in November. Month-on-month, the index rose 0.2% in December, seasonally adjusted, after falling 0.1% in November. The biggest contributor to the increase were airfares (+21.7%), offsetting the falling […]

Read more January 18

January 182019

US Dollar Gains on Mixed Data, China Trade News

The US dollar gained momentum on Friday, extending its gains over the past week. The greenback edged higher on mixed economic reports were released and breaking news that China is offering a $1 trillion-a-year olive branch on imports that could end the trade war almost immediately. Consumer sentiment cratered to its lowest level since President Donald Trump was elected. The University of Michigan index plunged from 98.3 in December to 90.7 […]

Read more January 18

January 182019

Pound Drops From 2-Month Highs as UK Retail Sales Disappoint

The British pound today fell from yesterday’s 2-month highs against the US dollar following Theresa May‘s victory in the no-confidence vote against her on Wednesday. The GBP/USD currency pair today declined as markets monitored Brexit developments amid low volatility. The GBP/USD currency pair today dropped from a high of 1.2993 in the Asian session to a low of 1.2926 in the European session. The cable’s decline today could largely be attributed to Brexit concerns […]

Read more January 18

January 182019

Swiss Franc Mixed After Bigger-than-Expected Decline of Producer Inflation

The Swiss franc was mixed today following the release of producer inflation data, which showed a bigger-than-expected decline. The general market sentiment was optimistic, weighing on safe currencies like the Swissie and the Japanese yen. The Federal Statistics Office reported that the Producer Price Index fell 0.6% in December from the previous month after falling 0.3% in November. Experts had predicted a much smaller decline by just 0.1%. Annual inflation was […]

Read more January 18

January 182019

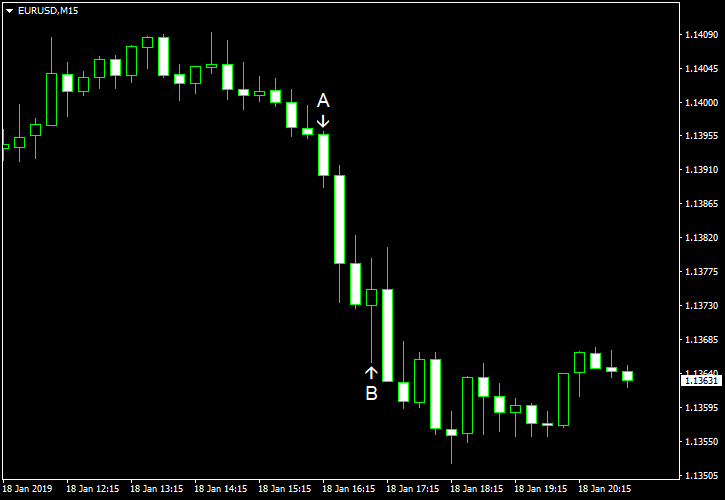

Euro Stabilizes as Investors Revise Their Expectations of an ECB Rate Hike

The euro today traded in a stable rage against the US dollar as investors revised their expectations of a rate hike by the ECB. The single currency was not appealing to investors who have had to deal with weak data releases from the eurozone and a dovish European Central Bank. The EUR/USD currency pair today traded in range marked by a high of 1.1409 and a low of 1.1385, but was attempting to break higher at the time of writing. The currency pair […]

Read more January 18

January 182019

Sterling Drops After Retail Sales Fall More than Expected

The Great Britain pound fell against other most-traded rivals, even the weak Japanese yen, after official data showed that retail sales declined last month. The Office for National Statistics reported that retail sales declined 0.9% in December compared with the previous month. Analysts had predicted a bit smaller decline by 0.8%. Furthermore, the November increase of 1.4% got a negative revision to 1.3%. Experts argued that the data […]

Read more January 18

January 182019

Japanese Yen Weak on Risk Appetite, Disappointing CPI Release

The Japanese yen fell against majority of its most-traded peers today due to risk appetite prevailing on markets. Disappointing inflation report was not helping the currency either. Japan’s core Consumer Price Index, which excludes fresh food, rose 0.7% in December from a year ago. That is compared to the increase of 0.9% registered in November and 0.8% predicted by analysts. Excluding both fresh food and energy, the index rose just […]

Read more January 18

January 182019

EUR/USD Declines amid Speculations About US Tariffs Rollback

EUR/USD declined today even as the US consumer sentiment worsened significantly this month. Yet the improving industrial production helped the dollar to gain on the euro. Another reason for the dollar’s strength was the rumor that the United States are considering lifting tariffs on Chinese imports. Industrial production rose 0.3% in December after increasing 0.4% in November (revised, 0.6% before the revision). Analysts had expected a bit smaller increase by 0.2%. Capacity […]

Read more