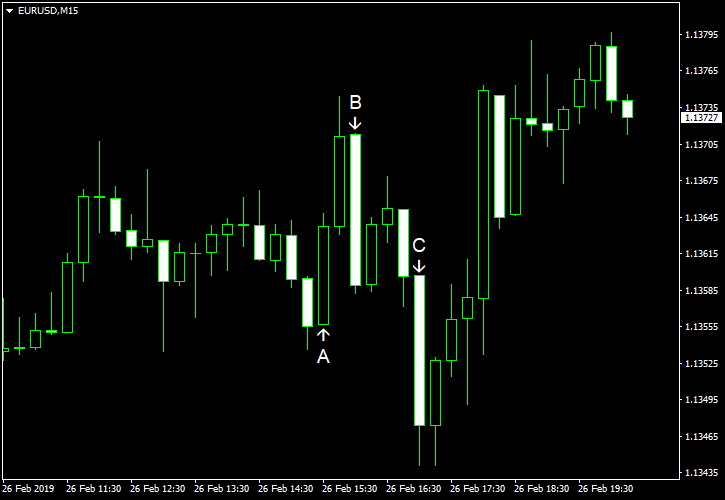

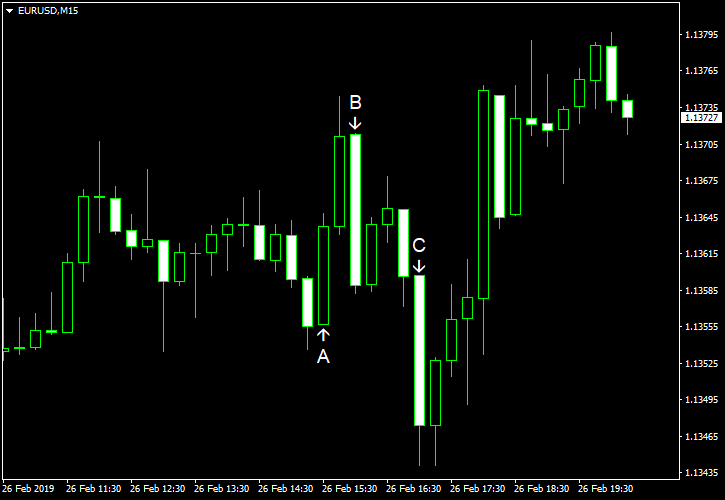

EUR/USD gained today. The currency pair rallied after disappointing macroeconomic reports in the United States. Wile the EUR/USD pair dipped after several positive US releases and the testimony of Federal Reserve Chairman Jerome Powell, it has managed to regain its strength by now.

Housing starts were at the seasonally adjusted annual rate of 1.08 million in December, down from the revised November estimate of 1.21 million (1.26 million before the revision). Analysts had predicted a bigger increase of 1.25 million. Building permits were at the seasonally adjusted annual rate of 1.33 million, little changed from the revised November estimate of 1.32 million. The analysts’ median forecast promised a figure of 1.29 million. (Event A on the chart.)

S&P/Case-Shiller home price index rose 4.2% in December from a year ago. That is compared to the forecast growth by 4.5% and the 4.6% increase registered in November. Month-on-month, the index fell 0.2%. (Event B on the chart.)

Richmond manufacturing index climbed from -2 in January to 16 in February, far above the forecast value of 6. (Event C on the chart.)

Consumer confidence surged to 131.4 in February from 121.7 in January. Market participants had expected a smaller increase to 124.8. (Event C on the chart.)

Yesterday, a report on wholesale inventories was released, showing an increase of 1.1% in December. Analysts had expected the same 0.3% rate of increase as in November. (Not show on the chart.)

If you have any comments on the recent EUR/USD action, please reply using the form below.