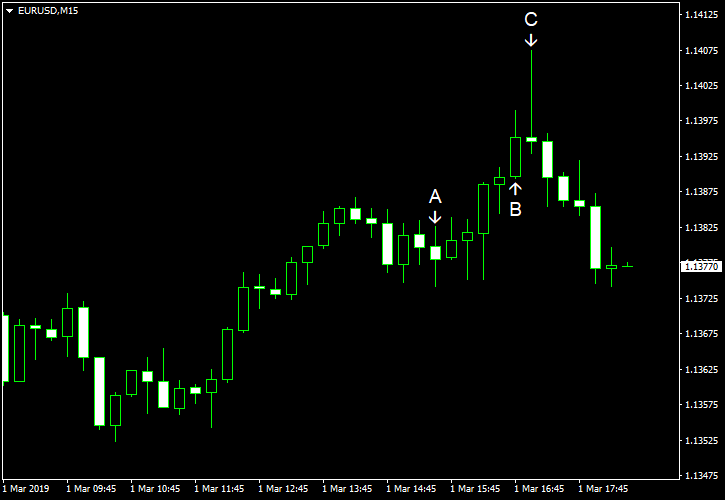

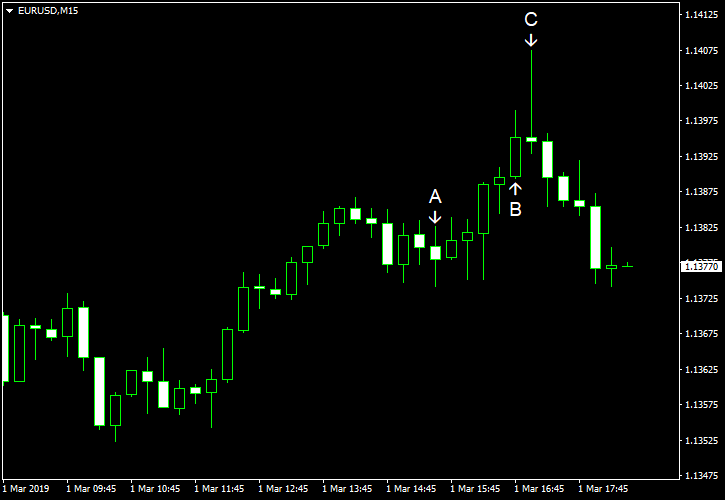

EUR/USD attempted to rally today on the back of US macroeconomic reports, virtually all of which were worse than expected. The currency pair was unable to hold onto gains for long, though, and has retreated to trade just slightly above the opening level by now.

Due to the government shutdown, the December estimates for personal income and spending as well for core PCE inflation came out just today, while January data was only available for income. Personal income fell 0.1% in January after rising 1.0% in December and 0.3% in November. That is compared to the forecast of an increase by 0.3% in January and 0.5% in December. Personal spending dropped 0.5% in December after rising 0.6% in November, while analysts had predicted a smaller decline by 0.2%. Core PCE inflation was at 0.2% in December, the same as in November and matching expectations. (Event A on the chart.)

Markit manufacturing PMI dropped to 53.0 in February from 54.9 in January, reaching the lowest level since August 2017, according to the final estimate. Analysts had expected the same 53.7 figure as in the preliminary report. (Event B on the chart.)

ISM manufacturing PMI dropped to 54.2% in February from 56.6% in January, below the consensus forecast of 55.6%. (Event C on the chart.)

Michigan Sentiment Index climbed to 93.8 in February from 91.2 in January according to the final estimate. (Event C on the chart.) Still, it was below the forecast value of 95.8 and the preliminary figure of 95.5. Indeed, the report said:

Although sentiment was still above last month’s low, the bounce-back from the end of the Federal shutdown faded in late February. While the overall level of confidence remains diminished, it is still quite positive. Nonetheless, aside from last month, it was only lower in one month since Trump’s election, but barely, at 93.4 in July 2017.

If you have any comments on the recent EUR/USD action, please reply using the form below.