- December 21, 2020 Do we get tax benefits on Personal Loan?

- December 18, 2020 The solicitors Preston depends on for stress-free compensation claims

- December 16, 2020 eToro: History and Key Features

- December 11, 2020 Canadian Dollar Pauses 2020 Rally Against US Peer Amid Falling Crude Prices

- December 11, 2020 Pound Crashes Against Dollar As No-Deal Brexit Appears Imminent

- December 11, 2020 USD/JPY 104.57 High Starting a New Bearish Leg?

Day: March 5, 2019

March 5

March 52019

Swiss Franc Loses Gains, Rising CPI Unable to Help

The Swiss franc attempted to rally during the Tuesday’s trading session on risk aversion caused by bad news from China. The Swissie failed to hold onto gains, though, and retreated against all other most-traded currencies by the end of the trading session. Positive domestic data was unable to support the currency. Switzerland’s Federal Statistical Office reported that the Consumer Price Index rose 0.4% in February from the previous month, matching market expectations […]

Read more March 5

March 52019

Canadian Dollar Weakens to Five-Week Low Ahead of BOC Decision

The Canadian dollar weakened to its lowest level against its American counterpart in five weeks. The multi-week low comes ahead of the central bank announcing its intentions on interest rates, and the worldâs second-largest economy potentially striking a blow to the slowing Canadian economy. The loonie was lifted by a modest bump in energy prices. On Wednesday, the Bank of Canada (BOC) is expected to leave its benchmark rate at 1.75%, after raising rates 125 basis […]

Read more March 5

March 52019

British Pound Declines on Brexit Cloud Amid Strong US ISM Data

The Sterling pound today fell against the US dollar despite the release of an upbeat fundamental print from the UK docket. The GBP/USD currency pair was weighed down by the looming Brexit deadline, which is just 24 days away with little sign of a deal being signed within the time left. The GBP/USD currency pair today rose to a high of 1.3198 in the early European session before falling to a low of 1.3098 in the American session […]

Read more March 5

March 52019

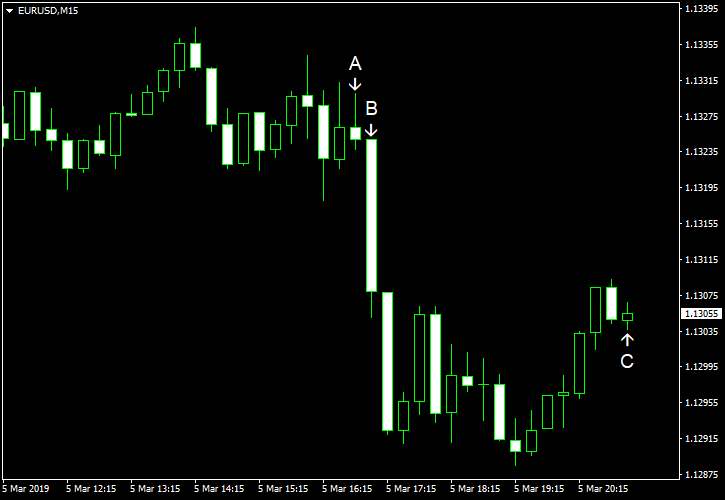

Euro Drops on Weak Chinese Data Despite Strong Eurozone PMIs

The euro today extended yesterday’s decline in the Asian session against a much stronger US dollar before rallying slightly in the early European session. However, the rally was not sustained as the pressure of weak Chinese growth forecasts weighed on the markets risk sentiment; the EUR/USD pair slid to new lows in the American session. The EUR/USD currency pair today traded mostly in a range marked by a high of 1.1338 and a low of 1.1314 before breaking lower in the US […]

Read more March 5

March 52019

Australian Dollar Soft Despite Positive Domestic Fundamentals

The Australian dollar was soft today even as domestic fundamentals were supportive to the currency. The likely reason for the currency’s weakness was bad news from China. Currently, the Aussie has trimmed its losses versus most majors. The Reserve Bank of Australia kept is main interest rate unchanged at 1.5% today, as was widely expected. Traders watched the accompanying statement closely, fearing it to be dovish. Yet it turned […]

Read more March 5

March 52019

NZ Dollar Soft After China Slashes Growth Target

The New Zealand dollar slumped against its most-traded rivals today. The likely reason for the significant drop was news from China as domestic fundamentals looked good, giving the currency no reason to decline. China lowered its target for economic growth from 6.5% to a more flexible range of 6.0%-6.5%. The news was considered an evidence that the trade war with the United States had a tremendous negative impact on the Chinese economy. Indeed, […]

Read more March 5

March 52019

EUR/USD Falls on US Treasury Yields, Positive US Economic Data

EUR/USD fell today. Positive US macroeconomic reports were pushing the currency pair down, though market analysts pointed at the rising US Treasury yields as another possible reason for the decline. Basically all of economic reports released in the United States today were good, and most of them beat expectations. Markit services PMI climbed to 56.0 in February from 54.2 in January according to the final estimate. The actual figure was not far […]

Read more