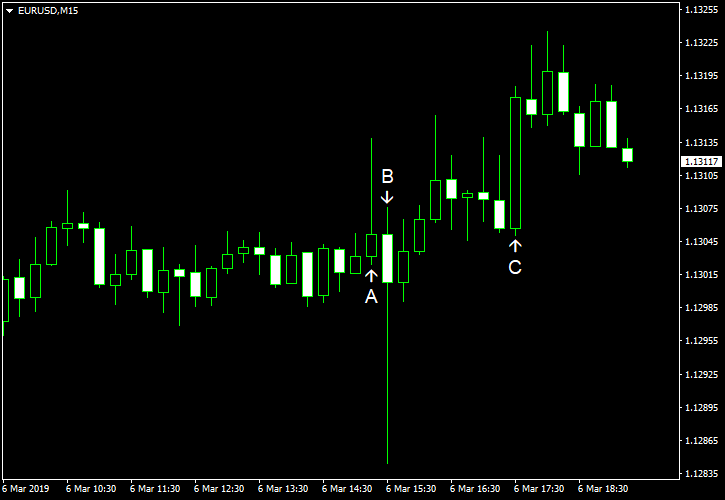

EUR/USD was volatile after macroeconomic releases in the United States but ultimately decided to go upside. That is not surprising as basically all of US indicators released today were disappointing.

ADP employment rose by 183k from January to February, slightly less than markets had expected — 190k. The previous month’s already substantial increase got a huge positive revision from 213k to 300k. (Event A on the chart.)

US trade balance deficit widened to $59.8 billion in December from $50.3 billion in November (revised, $49.3 billion before the revision). Economists had predicted a smaller deficit of $57.8 billion. (Event B on the chart.)

Crude oil inventories swelled by 7.1 million barrels last week, much more than experts had forecast — 1.2 million barrels, and were above the five-year average for this time of year. The week before, the stockpiles dropped by 8.6 million barrels. Total motor gasoline inventories decreased by 4.2 million barrels but also remained above the five-year average. (Event C on the chart.)

If you have any comments on the recent EUR/USD action, please reply using the form below.