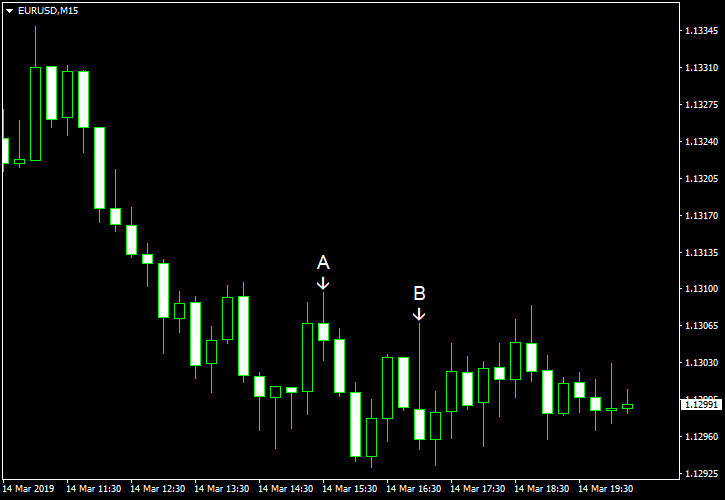

EUR/USD declined today, ending its four-day rally. There were several possible reasons for that. Some analysts named German inflation, which missed expectations, as one of them. But surprisingly, the currency pair actually rose after the release, not fell. Other reasons named by market analysts were concerns about the Brexit and somewhat weak Chinese macroeconomic indicators. As for US macro reports:

Both import and export prices rose 0.6% in February. That is compared to the increase by 0.1% of import prices and the decrease by 0.5% of export prices in January. Analysts had predicted a smaller increase of import prices by 0.3%. (Event A on the chart.)

Initial jobless claims rose from 223k to 229k last week, a bit higher than analysts had predicted — 225k. (Event A on the chart.)

New home sales were at the seasonally adjusted annual rate of 607k in January, down from the revised December rate of 652k (621k before the revision). That is compared to the consensus forecast of 622k. (Event B on the chart.)

If you have any comments on the recent EUR/USD action, please reply using the form below.