EUR/USD dropped today as basically all macroeconomic reports for the eurozone released today were bad. US economic data were bad for the most part as well (with the exception of the housing data) but that did not prevent the dollar from gaining on the euro.

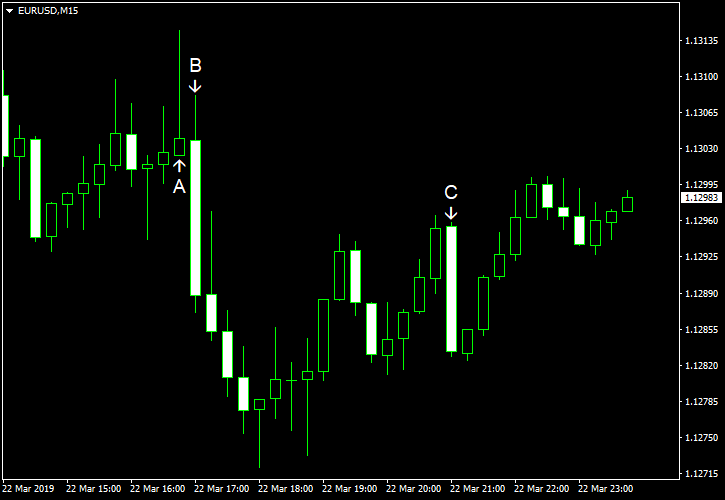

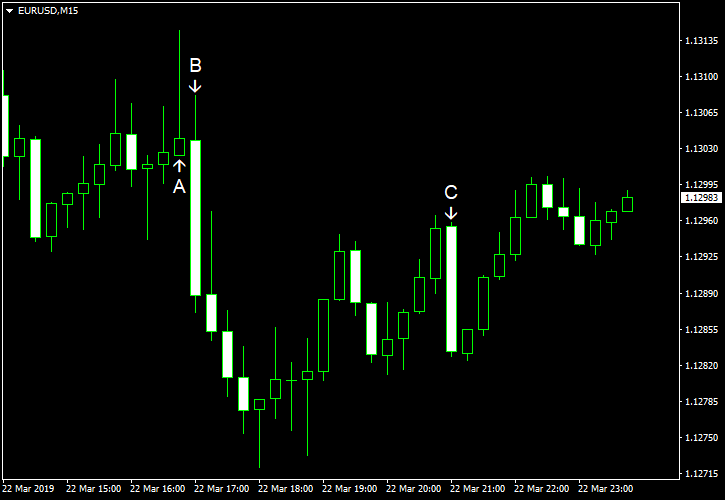

Flash readings for Markit manufacturing PMI and Markit services PMI were released today. Manufacturing PMI dropped to 52.5 in March from 53.0 in February instead of rising to 53.5 as analysts had predicted. It was the lowest reading in almost two years. Services PMI declined to 54.8 from 56.0, below the forecast level of 55.7. (Event A on the chart.)

Existing home sales jumped to the seasonally adjusted annual rate of 5.51 million in February from 4.93 million in January, beating the average forecast of 5.10 million. (Event B on the chart.)

Wholesale inventories jumped 1.2% in January from 1.1% in December. That is compared to an increase by just 0.2% predicted by analysts. (Event B on the chart.)

Treasury budget deficit was at $234.0 billion in February, exceeding the deficit of $228.0 billion predicted by analysts. The budget logged a surplus of $8.7 billion in January. (Event C on the chart.)

If you have any comments on the recent EUR/USD action, please reply using the form below.