- December 21, 2020 Do we get tax benefits on Personal Loan?

- December 18, 2020 The solicitors Preston depends on for stress-free compensation claims

- December 16, 2020 eToro: History and Key Features

- December 11, 2020 Canadian Dollar Pauses 2020 Rally Against US Peer Amid Falling Crude Prices

- December 11, 2020 Pound Crashes Against Dollar As No-Deal Brexit Appears Imminent

- December 11, 2020 USD/JPY 104.57 High Starting a New Bearish Leg?

Day: April 22, 2019

April 22

April 222019

Chinese Yuan Weakens Despite Positive Outlook, Continued Stimulus

The Chinese yuan is sliding against some of its most traded currency pairs on Monday. As the yuan weakens, there is a positive outlook for the Chinese economy on the market, particularly as Beijing confirming that it will continue to support its economy. Industrial metals steel and iron ore soared on Monday after the federal government announced it would maintain stimulus support for the worldâs second-largest economy. The Communist Party said it would […]

Read more April 22

April 222019

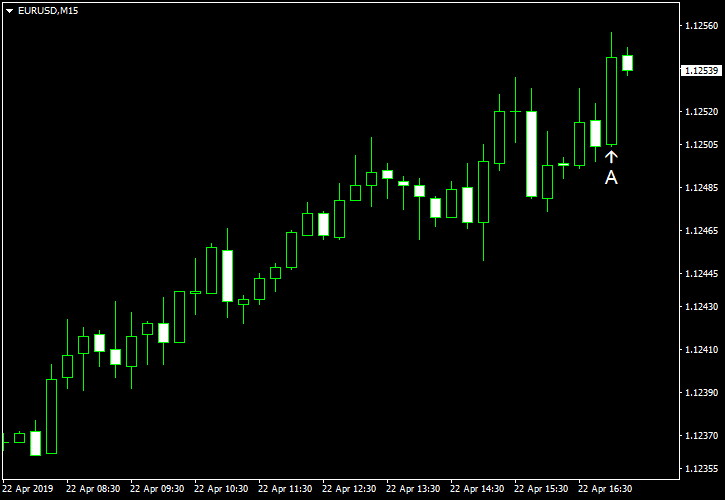

EUR/USD Rises in Post-Holiday Light Trading

Markets opened after the Easter holiday, but there were few events to move them. The only macroeconomic indicator released in the United States today missed expectations, and it may be partially responsible for today’s rally of EUR/USD. Existing home sales were at the seasonally adjusted annual rate of 5.21 million in March, missing market expectations of 5.31 million. Furthermore, the February figure got a negative revision from 5.51 million to 5.48 […]

Read more April 22

April 222019

Norwegian Krone Follows Crude Oil in Rally

The Norwegian krone gained today as the rally of crude oil boosted currencies of oil exporting nations. The Norway’s currency rallied today for the same reason as the Canadian dollar — the sharp rise of crude oil prices. Norway exports crude oil, therefore it was positive news for the nation’s currency. There are concerns, though, that risk aversion can hurt risk-sensitive commodity currencies, including the krone and the loonie. USD/NOK slipped from 8.5127 […]

Read more April 22

April 222019

Canadian Dollar Rises with Crude Oil, Gains Capped by BoC Worries

The Canadian dollar gained against other most-traded currencies today thanks to a big rally of crude oil. But gains were limited as market participants were waiting for the monetary policy decision of Canada’s central bank later this week. According to a report from Washington Post, today the United States will announce an end of Iran sanctions waivers. The USA implemented sanctions against the Middle Eastern nation some time ago but […]

Read more April 22

April 222019

USD/SEK Edges Higher Ahead of This Week’s Riksbank Meeting

The Swedish krona fell against the US dollar a bit today ahead of this week’s monetary policy meeting of Sweden’s central bank. The Riksbank will hold a monetary policy meeting on Thursday. While market participants do not expect changes to interest rates, they will watch the accompanying press conference for hints about the central bank’s plan. Another important event will be the release of the Producer Price Index and retail sales data […]

Read more April 22

April 222019

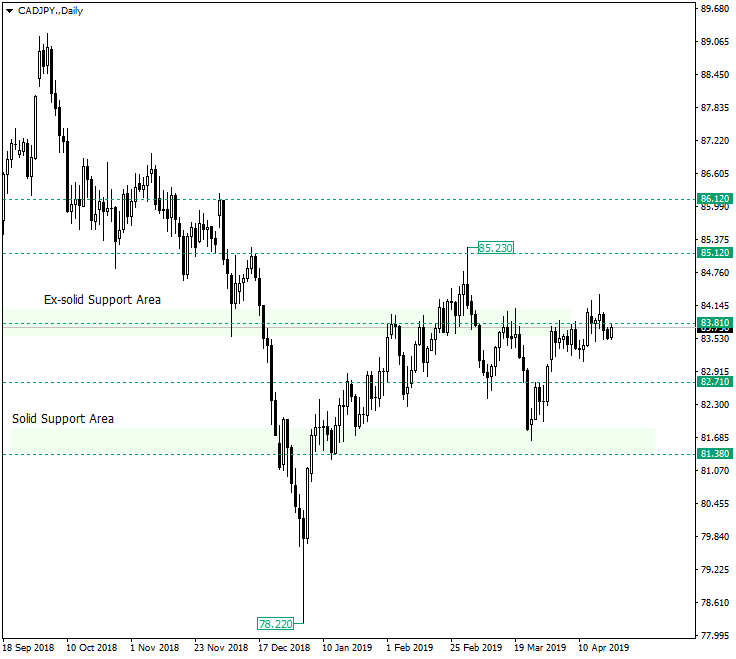

CAD/JPY Trying to Keep Things on Track

The Canadian dollar versus the Japanese yen is testing the important ex-solid support area of 83.81. Long-term perspective After bouncing from the currently solid support area of 81.38 on March 25, 2019, the price managed to surpass the 82.71 intermediary level and extend just under 83.81. There it entered a consolidation phase that lasted until almost the middle of April, on April 12, 2019, the price attempting to break the bearish barrier at 83.81 […]

Read more